Rich Dad Poor Dad Cashflow Quadrant Summary | 2024 Guide

Do you wonder why rich people get richer and richer while poor people get poorer and poorer?

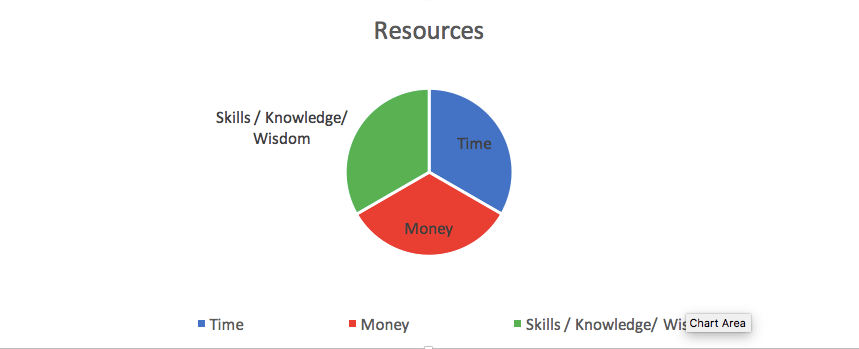

Everyone owns 24-hour each day, starts to accumulate learning experience, knowledge, skillsets, wisdom and money from nothing for everyone born. The only difference between rich and poor is mindset, as well as lateral thinking.

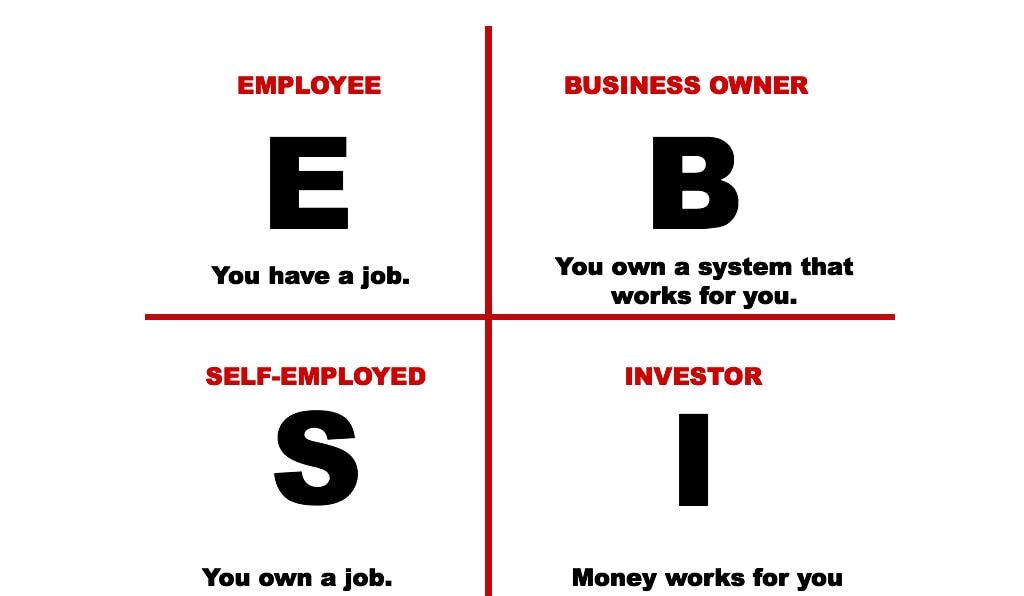

Let me explain the cash flow quadrant framework, as it was introduced in Robert Kiyosaki’s a “Rich Dad Poor Dad” book:

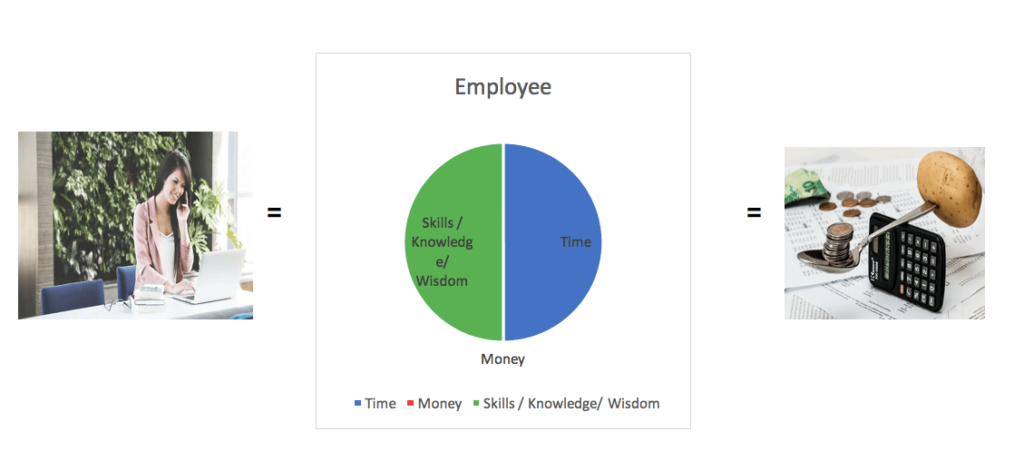

At the employee quadrant, after most people graduate from university, college, or secondary school, they will find a good job and stable job from 9 am to 5 pm. Especially, they prefer working in the big corporate firm and living in the comfort zone and at the end of the month, they are very happy because they earn and receive monthly income from the employer. This kind of people is always trading the time and skills as well as knowledge with money because they own time and certificate of professional skills as well as knowledge like engineers, doctors, accountants, lawyers etc.

They prefer saving money in the bank account and receive little interest from the bank. Until one day, they discover the little percentage increment rate of salary income and the inflation will depreciate the money they save in the bank.

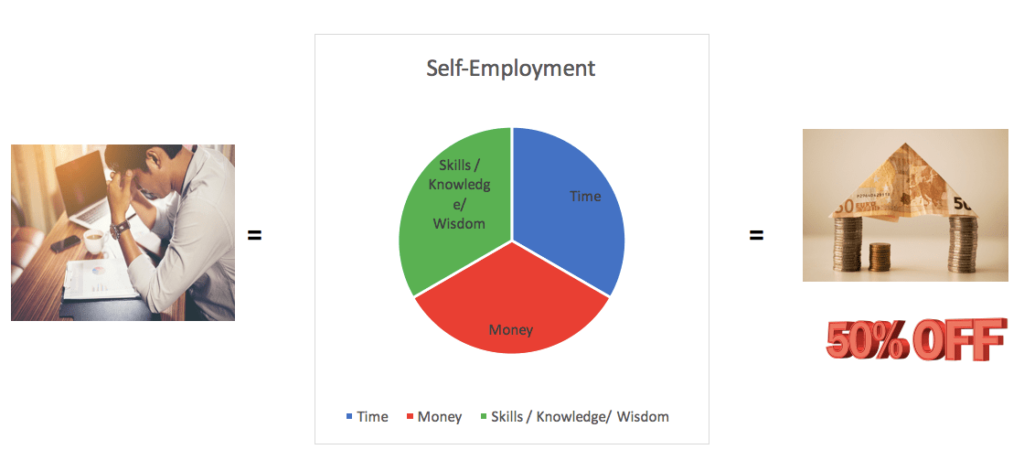

At the Self-Employed quadrant, this kind of people owns equally resources, time, money, and skillsets as well as knowledge. They start to learn online and offline marketing, negotiation, sale, human resource, accounting, tax as well as finance, law and regulation, operation, system and much more. They look like “fire fighter” become self-employed. When there are issues in the marketing department, they start to “put out” fire. When outsourcing tasks to freelancers and buying software tools or system, their mind starts to annoy them and wish there are a huge discount on them.

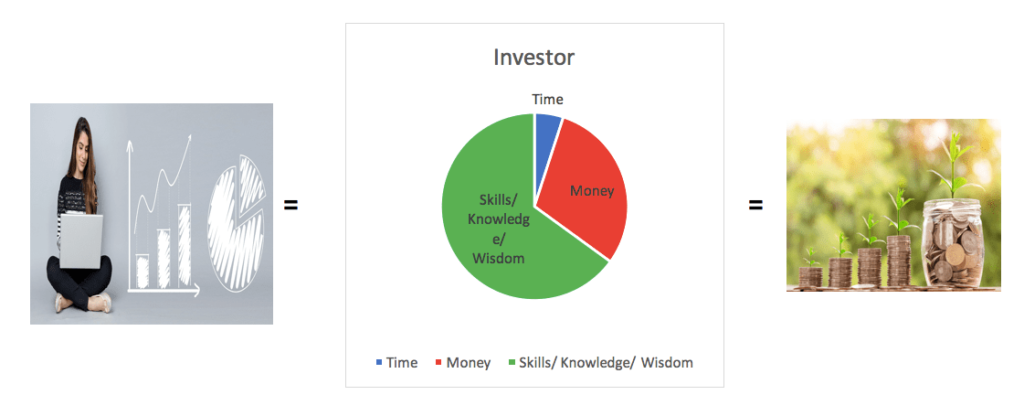

At the investor quadrant, this kind of people start to do personal finance, keep tracking income and expense every month, read personal finance and investing books as well as financial statements and buy successful people experience and proven principle from investing academy.

As an investor, the value investing and option strategies skillsets, knowledge, experience, investing mindset is the significant part of investing life in stock and options market. They prefer money work hard for them and focus on what they need rather than want.

After analysis, they allocate partial money and invest in assets as ownership of a partial business. They prefer fast growth and wide-moat companies and high-consistent-dividend sustainable because of capital gain appreciation and high dividend yield toward financial freedom.

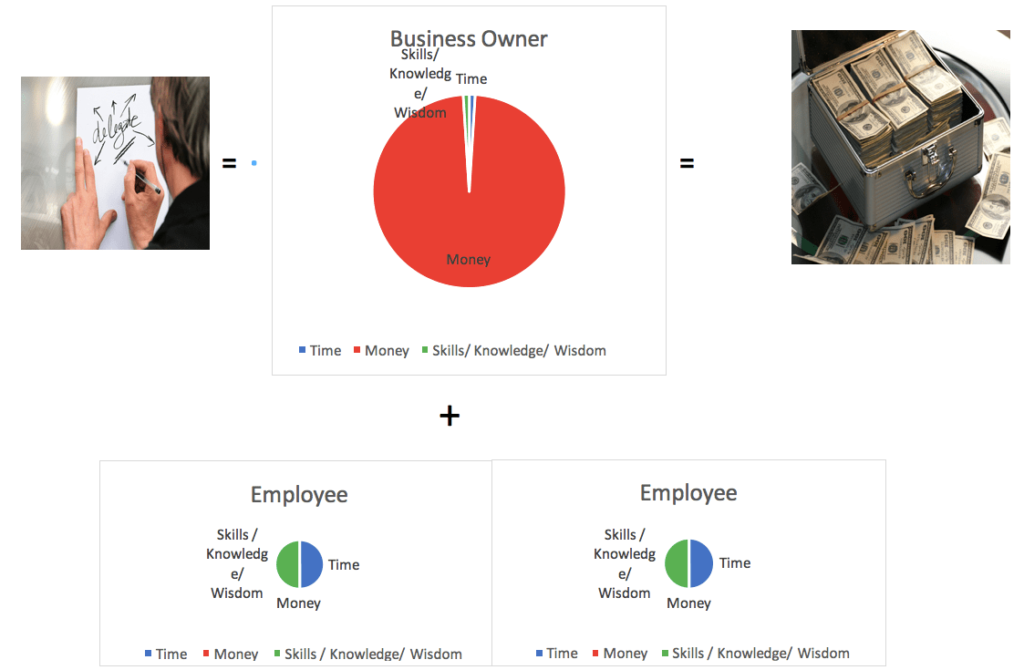

At the business owner quadrant, this kind of people prefer solving problems, start to do fund-raising from investors, do research niche market, build a sustainable-scalable-adaptable business model, acquisition of customers, hiring right people at the right ship and build a bonding team, create the culture and much more.

As you can see, this kind of people understand how to delegate tasks to right people and therefore help them build wealth.

At the end of the day, shifting from employee and self-employed positions into the business owner and investor position will make you wealthy and fulfilment in your life.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

- By Kristina F.

Trending Posts

5 Secrets and Tips How to Choose and Open a Durian while Living in Singapore | 2024 Guide

Amazon Customer Centric Strategy: Why There Is An Empty Chair In Every Meeting in Amazon?

Trending Posts

5 Secrets and Tips How to Choose and Open a Durian while Living in Singapore | 2024 Guide

Amazon Customer Centric Strategy: Why There Is An Empty Chair In Every Meeting in Amazon?

8 Best iPhone Repair Service Shops in Singapore | Best of 2024

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com