-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

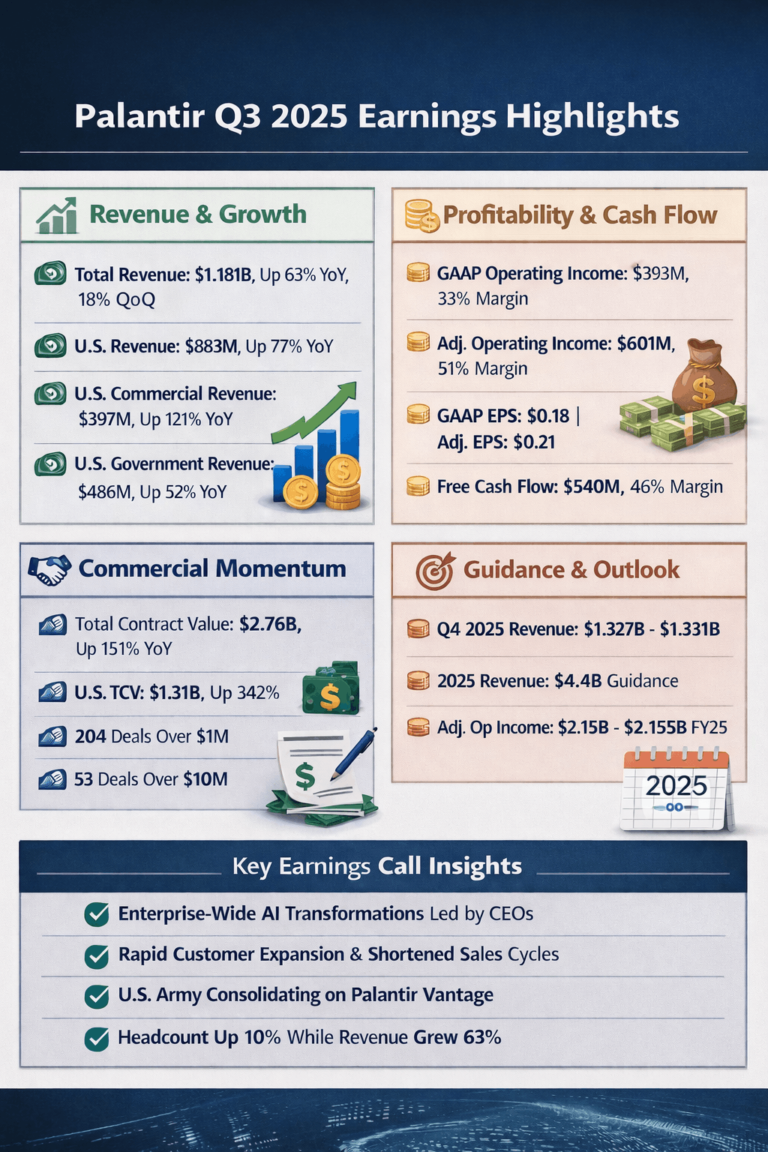

Palantir delivered one of its strongest quarters ever in Q3 2025, with explosive U.S. commercial growth, record contract value wins, and extremely high profitability for a high-growth software company. Beyond the official press release and investor deck, the earnings call transcript revealed deeper strategic signals about enterprise AI adoption, customer behavior shifts, and operating leverage that investors should pay attention to.

Below is a combined listicle covering official financial highlights, forward guidance, management strategy commentary, and the most important hidden signals from the earnings call.

Table of Contents

Revenue and growth

Total revenue: $1.181 billion, up 63% year over year and 18% quarter over quarter

US revenue: $883 million, up 77% year over year

US commercial revenue: $397 million, up 121% year over year and 29% quarter over quarter

US government revenue: $486 million, up 52% year over year

Profitability and cash flow

GAAP operating income: $393 million, 33% margin

Adjusted operating income: $601 million, 51% margin

GAAP net income: $476 million, 40% margin

GAAP EPS: $0.18

Adjusted EPS: $0.21

Adjusted free cash flow: $540 million, 46% margin

Cash, cash equivalents, and short-term treasuries: $6.4 billion

Commercial momentum and deals

Total contract value (TCV): $2.76 billion, up 151% year over year

US commercial TCV: $1.31 billion, up 342% year over year

US commercial remaining deal value (RDV): $3.63 billion, up 199% year over year

Deals closed in Q3:

204 deals over $1 million

91 deals over $5 million

53 deals over $10 million

Customer count: up 45% year over year

Rule of 40 and efficiency

Rule of 40 score: 114%

Adjusted operating margin: 51%

Strong operating leverage alongside rapid growth

Revenue: $1.327 to $1.331 billion

Adjusted operating income: $695 to $699 million

Full year 2025 updated guidance

Revenue: $4.396 to $4.400 billion

US commercial revenue: above $1.433 billion, at least 104% growth

Adjusted operating income: $2.151 to $2.155 billion

Adjusted free cash flow: $1.9 to $2.1 billion

Management expects GAAP operating income and net income in every quarter of 2025

Management repeatedly stressed that deals are no longer about single use cases. Customers are reorganizing entire enterprises around Palantir AIP, with CEOs personally owning AI transformations. This shift to enterprise-wide deployments and org-level reorgs is discussed extensively on the call but not explicitly highlighted in the press release.

Executives described customers moving from first contract to multi-year, large-scale expansion in months, not years. One example cited was an eightfold ACV expansion just five months after initial contract. The press release shows strong TCV numbers but does not explain how fast customers are upgrading and expanding.

Shyam Sankar went deep on AI FDE (AI development agents) and AI Hivemind, explaining how two human engineers plus AI agents replaced years of system integrator work in days. These products are mentioned lightly in materials, but the transcript makes clear they are already in production and driving real deployments. This is largely absent from the press release narrative.

Shyam disclosed that the U.S. Army issued a public memo directing all Army organizations to consolidate on Vantage (built on Foundry + AIP). This is a major strategic government win with long-term implications, but it is not highlighted in the press release bullet points.

Management explicitly stated that Palantir headcount is up only about 10%, while revenue is up 63%, attributing this to internal use of AI FDEs to massively boost productivity. This operating leverage story is not clearly stated in the press release.

Alex Karp said U.S. growth is even more impressive because Europe is stagnant and dragging overall results. This geographic weakness is not mentioned in the press release, which focuses on headline growth.

Karp and Taylor described customers effectively doing “private equity–style transformations” in public companies, reorganizing operations around Palantir. This reframes Palantir as a transformation partner, not just a software vendor, which is not captured in the press release language.

Management hinted at multiple large defense and national security opportunities (NGC2, Maven, multi-theater conflicts) but declined to name specifics. This suggests upside optionality not reflected in official guidance or press materials.

Palantir is showing rare combination of hyper growth and elite profitability, driven mainly by U.S. commercial AI adoption through AIP. The transcript suggests customers are moving from testing AI to restructuring entire companies around it. The biggest upside is enterprise scale AI transformation and strong operating leverage. The main risks are heavy dependence on U.S. growth, high expectations priced into the story, and reliance on continued AIP leadership versus competitors.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

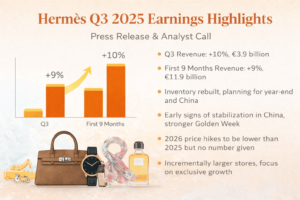

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com