-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

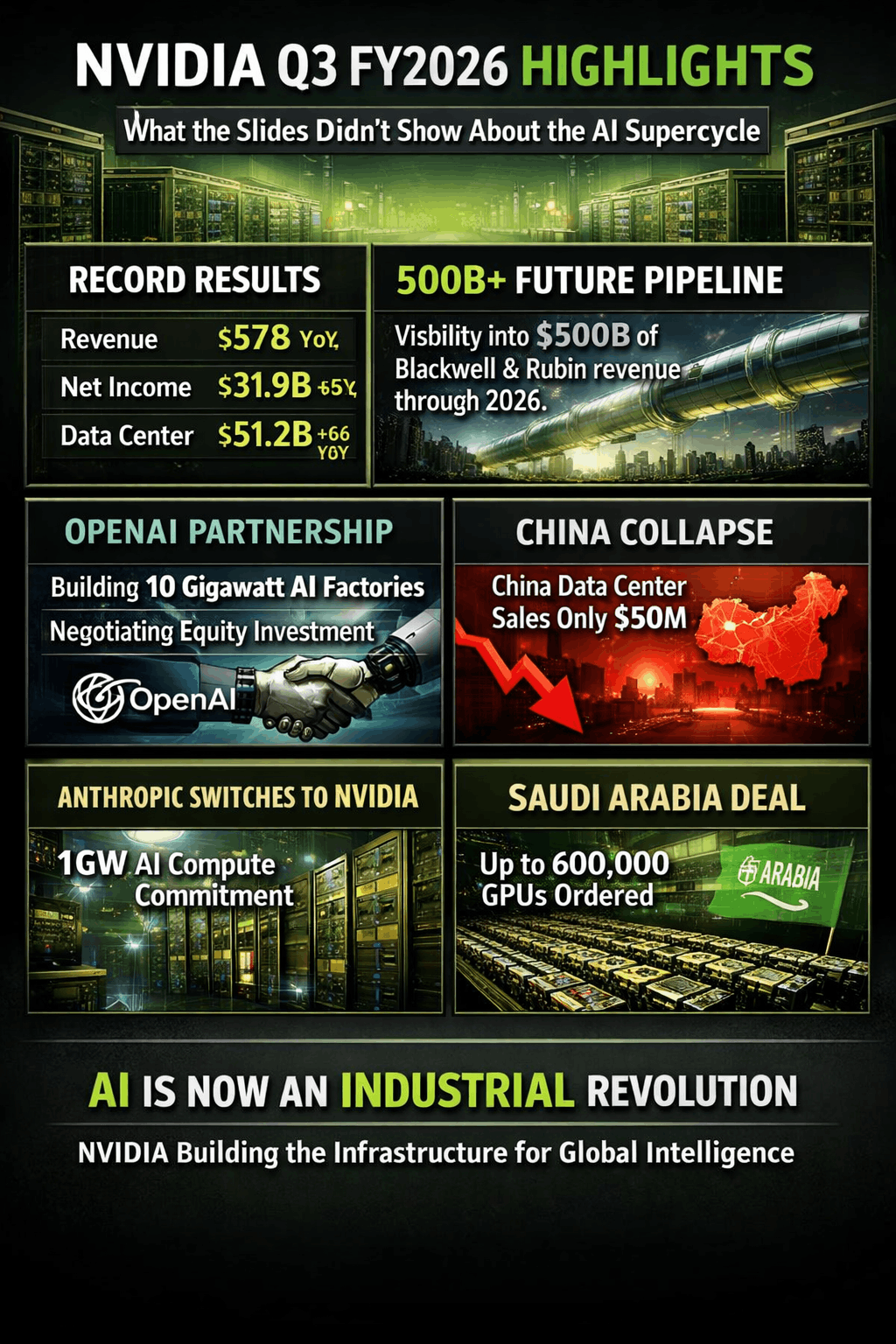

NVIDIA just reported one of the most extraordinary quarters in corporate history. Most investors only look at the investor presentation, which showed record revenue, strong margins, and explosive data center growth.

But the real story was hidden inside the earnings call transcript. That is where NVIDIA revealed how deep, wide, and unstoppable the AI buildout has become.

This article combines both the official financial results and the strategic disclosures that were only discussed verbally during the earnings call.

Table of Contents

Fiscal quarter ended Oct 26, 2025:

| Metric | Q3 FY2026 | YoY Change | QoQ Change |

|---|---|---|---|

| Revenue | 57.0 billion USD | +62% | +22% |

| Net income | 31.9 billion USD | +65% | N/A |

| GAAP EPS | 1.30 USD | +67% | N/A |

| Non-GAAP EPS | 1.30 USD | +60% | N/A |

Where the growth came from:

| Segment | Q3 FY2026 Revenue | YoY Growth | QoQ Growth |

|---|---|---|---|

| Data Center | 51.2 billion USD | +66% | +25% |

| Compute (within Data Center) | 43.0 billion USD | +56% | N/A |

| Networking (within Data Center) | 8.2 billion USD | +162% | N/A |

| Gaming | 4.27 billion USD | +30% | N/A |

| Professional Visualization | 760 million USD | +56% | N/A |

| Automotive | 592 million USD | +32% | N/A |

NVIDIA reported Q3 FY2026 revenue of 57.0 billion USD, up 62 percent year over year and up 22 percent sequentially.

Net income reached 31.9 billion USD and earnings per share jumped to 1.30 USD, a 67 percent increase from last year.

Data Center revenue alone reached 51.2 billion USD, growing 66 percent year over year, driven by Blackwell, AI factories, and hyperscaler demand.

But this was just the surface.

Blackwell Ultra is now NVIDIA’s leading architecture across all customer categories.

GB300 now contributes about two-thirds of Blackwell revenue.

Hopper still generated about 2 billion USD in the quarter.

NVIDIA now sees visibility into 500 billion USD of Blackwell and Rubin revenue from early 2025 through the end of 2026.

NVIDIA estimates the total AI infrastructure build will reach 3 to 4 trillion USD per year by the end of the decade.

NVIDIA confirmed that cloud providers are sold out and that the GPU installed base across Blackwell, Hopper and Ampere is fully utilized.

Analysts now estimate 2026 hyperscaler capex at about 600 billion USD, more than 200 billion USD higher than earlier in the year.

AI customers driving this demand include OpenAI, Anthropic, xAI, Mistral, Reflection, Thinking Machines Lab, and others.

Networking revenue reached 8.2 billion USD, up 162 percent year over year, making NVIDIA the largest networking business in the world.

Meta, Microsoft, Oracle and xAI are building gigawatt-scale AI factories using NVIDIA Spectrum-X Ethernet and NVLink.

NVIDIA introduced Rubin NVL72, a data-center-scale AI supercomputer that delivers exaflop-level performance with tens of terabytes of memory. This enables companies to train and run massive AI models, digital twins, and robot brains at unprecedented speed.

It delivers Exaflop-level AI performance Over 50 TB of memoryPetabytes per second of bandwidth

This lets companies train massive AI, robot brains, and digital twins far faster and cheaper than today.

This was never shown in the slides.

NVIDIA disclosed that Hopper platform sales were about 2 billion USD in the quarter, but China-compliant H20 GPUs only generated around 50 million USD.

Large China data center orders did not happen due to geopolitics and rising competition.

This means NVIDIA is achieving record growth even after effectively losing one of the world’s largest AI markets.

NVIDIA is working with OpenAI to build at least 10 gigawatts of AI data centers, a scale comparable to a national power grid.

NVIDIA is also negotiating an equity investment in OpenAI, making it a financial partner in the world’s most important AI company.

Anthropic has moved to NVIDIA for the first time and committed up to 1 gigawatt of compute using Grace Blackwell and Rubin systems.

This is one of the most important competitive wins in enterprise AI.

NVIDIA announced that AI factory and infrastructure projects disclosed in this quarter alone total about 5 million GPUs.

These include xAI’s Colossus 2, Lilly’s drug discovery AI factory, and multiple sovereign and enterprise data centers.

A single Saudi Arabia agreement includes 400,000 to 600,000 GPUs over three years, on top of the existing 500 billion USD Blackwell and Rubin pipeline.

| Item | Q3 FY2026 |

|---|---|

| Cash and marketable securities | 60.6 billion USD |

| Operating cash flow | 23.8 billion USD |

| Shareholder returns (buybacks + dividends) | 12.7 billion USD |

| Metric | Guidance |

|---|---|

| Revenue | 65.0 billion USD ± 2% |

| Non-GAAP gross margin | About 75% |

| Non-GAAP operating expenses | About 5.0 billion USD |

Three simultaneous platform shifts are driving NVIDIA’s growth.

i. CPU computing is shifting to ii. GPU-accelerated computing.

iii. Classical machine learning is shifting to generative AI.

Generative AI is shifting to agentic and physical AI.

All three transitions run on NVIDIA’s architecture, making NVIDIA the core infrastructure provider for every phase of AI across cloud, enterprise and robotics.

NVIDIA quarterly revenue has risen from 22.1 billion USD in Q4 FY2024 to 57.0 billion USD in Q3 FY2026, driven primarily by data center growth.

NVIDIA is no longer just selling GPUs.

It is now building the global infrastructure for intelligence itself, controlling chips, networking, software, power efficiency, AI factory design, and increasingly, financing and offtake of AI capacity.

That is why the AI supercycle is not slowing down. It is only beginning.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com