-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

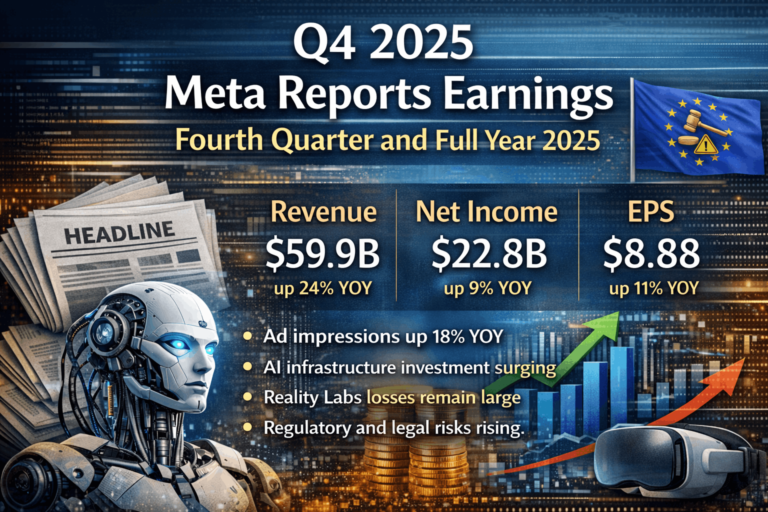

Meta just released its latest earnings results – Q4 2025 together with 2026 guidance. On the surface, the story is simple: strong ad growth, strong revenue, and aggressive AI investment. But when combining both the official press release highlights and the deeper signals typically discussed in earnings calls and investor materials, a much more strategic story appears.

Below is a combined investor + strategic breakdown of what really matters.

Table of Contents

Meta delivered about 59.9B revenue in Q4 2025, up about 24% YoY, and about 201B for full year 2025, up about 22% YoY. For a company already at mega scale, this is extremely strong growth.

Why it matters

This confirms Meta is still gaining share in global digital advertising despite competition from TikTok, retail media networks, and AI search shifts.

Ad impressions grew about 18% YoY in Q4 and average price per ad also increased. At the same time, daily active people reached about 3.58 billion.

Why it matters

Growing volume plus rising pricing is rare at this scale. It signals very strong advertiser demand and platform dependency.

Family of Apps generated massive operating income, while Reality Labs continues to generate multi-billion operating losses.

Why it matters

Meta is still fundamentally an ad cash machine funding long-term bets.

Meta expects 2026 capex to jump to about 115B to 135B versus about 72B in 2025.

Why it matters

This is not normal capex growth. This is hyperscaler-level AI infrastructure buildout.

Most expense growth in 2026 will come from infrastructure, cloud, depreciation, and AI talent hiring.

Why it matters

This suggests Meta wants to secure compute dominance before competitors.

Management expects 2026 operating income to exceed 2025 levels even with the AI spending surge.

Why it matters

This implies very strong pricing power in advertising and early AI monetization signals.

Employee compensation is expected to be the second largest contributor to expense growth.

Why it matters

The AI talent war is real. Meta is competing directly with hyperscalers and frontier model labs.

Reality Labs losses remain large and are expected to stay similar into 2026.

Why it matters

Metaverse remains a long-term optionality bet, not a near-term profit driver.

Detailed guidance mentions EU ad restrictions, youth safety scrutiny, and potential trial outcomes that could materially impact results.

Why it matters

Regulation is now a structural variable in Meta’s valuation.

Meta still generated strong operating cash flow and ended the year with over 80B in liquidity.

Why it matters

This gives Meta the ability to fund AI buildout without financial stress.

One-time tax impacts in 2025 distorted some comparability vs prior periods.

Why it matters

Underlying operating trend is stronger than headline full-year EPS might suggest.

Combining all signals together:

Massive compute investment

Massive AI hiring

Continued ad cash dominance

Willingness to compress free cash flow short term

This looks similar to Amazon AWS build phase or Microsoft cloud scale-up phase historically.

The press release tells a story of strong performance and confident guidance. The deeper investor materials suggest something bigger: Meta is shifting from being just the world’s largest social ad platform into becoming a full-stack AI infrastructure and application company.

For long-term investors, the real question is not whether Meta can fund AI. It is whether Meta can turn AI into a second profit engine alongside advertising.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

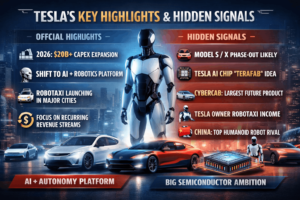

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Trending Posts

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com