-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Visa delivered strong Q1 FY2026 results with double-digit revenue and EPS growth. On the surface, the story looks simple: strong consumer spending, cross-border recovery, and steady global payments growth.

But the earnings call revealed deeper signals about regulation risk, political pressure on the payments ecosystem, and how Visa is positioning for AI, stablecoins, and next-generation commerce.

Below is a combined listicle of what the official results show and what management really signaled during the call.

Table of Contents

What official materials show

Strong transaction growth and continued expansion of value-added services.

What management commentary revealed

Value-added services grew roughly 28% and drove about half of total revenue growth.

Why this matters

Visa is becoming less dependent on raw transaction volume and more dependent on software, data, and services economics.

What official materials suggest

Innovation and platform expansion.

What management actually described

• 100+ ecosystem partners working on AI agent commerce

• Dozens already building live implementations

• Some production transaction flows already running

Why this matters

Visa is positioning to sit inside AI-driven transactions, not just human card usage.

What official narrative says

Stablecoins are part of long-term innovation.

What the call clarified

• ~$4.6B annualized settlement run rate

• Strong product-market fit mainly in emerging or unstable currency regions

• Limited consumer payment demand in developed digital markets

Why this matters

Stablecoins are currently expanding Visa’s rails, not replacing them

What official results show

Strong growth across money movement and digital payments.

What management explained

Fast-growing products like real-time money movement can have lower yield than traditional card transactions.

Why this matters

Revenue growth strong, but investors must watch margin mix over time

What official materials say

Consumer spending remains resilient.

What call commentary added

• High-income spend still strongest

• Lower-income spending stable

• Both discretionary and essential categories strong

• E-commerce still gaining share

Why this matters

This is macro-cycle signal, not just company signal.

What official materials highlight

Growth in tokenization and digital payment credentials.

What management emphasized

Long-term goal is eventually fully tokenized transaction ecosystems and multi-funding payment identities.

Why this matters

Switching costs increase dramatically when payments become embedded identity infrastructure.

What official narrative implies

Brand partnerships and sponsorship visibility.

What management explained

Events generate marketing services revenue, client campaigns, and long-term relationship lock-in.

Why this matters

These are service monetization opportunities, not just branding spend.

What official results show

Strong commercial payment growth.

What management commentary revealed

Growth coming from SMB digitization, virtual cards, and cross-border corporate payment flows.

Why this matters

Commercial payments TAM is larger and less penetrated than consumer cards.

What was NOT said

No mention of specific political figures or specific interest rate cap policies.

What management DID say

Certain regulatory proposals could:

• Reduce access to credit

• Remove reward programs

• Slow innovation

• Reduce payment security investments

Why this matters

Even without naming specific policy debates, management clearly signaled opposition to heavy ecosystem regulation.

If you combine call tone + strategy direction, Visa is evolving toward:

Global money movement operating system

AI transaction infrastructure

Stablecoin bridge between crypto and banking rails

Tokenized payment identity layer

B2B financial workflow backbone

Headline earnings show strong execution.

The earnings call reveals structural transformation.

Visa is shifting from

Card network → Financial technology infrastructure → AI-enabled global transaction layer.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

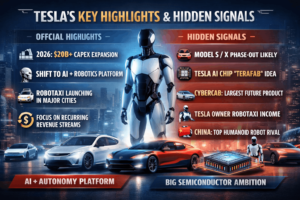

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Trending Posts

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com