-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

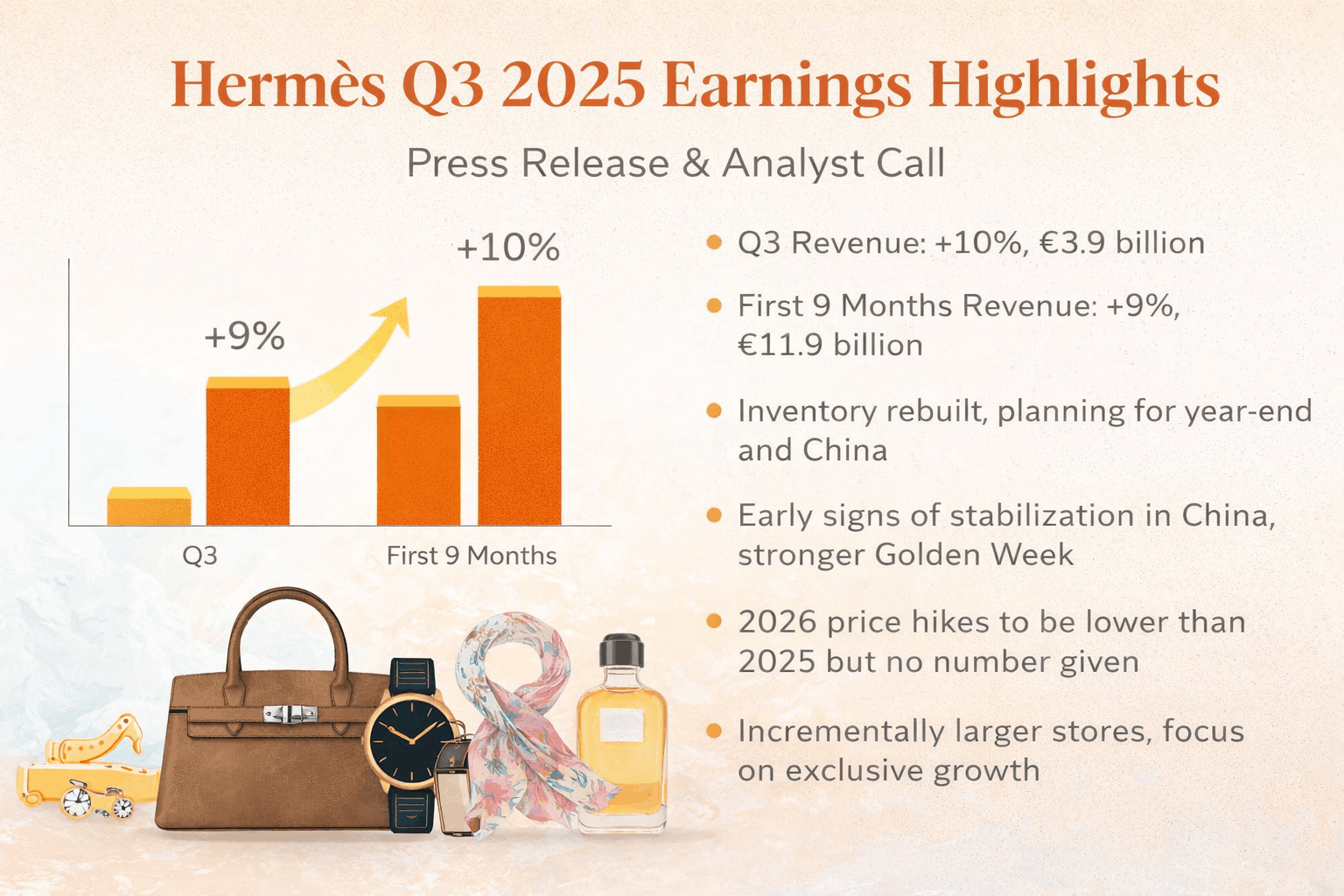

Hermès released its Q3 2025 earnings update showing steady growth despite a challenging global environment. On the surface, the press release paints a picture of stable luxury demand and disciplined execution. However, when combining the earnings release, presentation figures, and management’s comments during the analyst call, a clearer and more practical story emerges.

This article explains Hermès’ Q3 performance in simple terms and highlights what management discussed verbally but did not include in the official press release.

Table of Contents

Period covered

Third quarter and first nine months ended September 2025

Overall performance

• Q3 2025 revenue reached €3.9 billion

• Growth of +10% at constant exchange rates and +5% at current exchange rates

• First 9 months 2025 revenue reached €11.9 billion

• Growth of +9% at constant exchange rates and +6% at current exchange rates

• Performance slightly improved versus Q2, especially in Europe, Americas, and Asia

Management commentary

• Management emphasized resilience and consistency of the Hermès model

• Growth driven by loyal customer base and disciplined execution despite global uncertainty

Japan

• Strongest region

• +15% growth at constant exchange rates

• Growth driven mainly by loyal domestic customers

Americas

• +13% growth

• Acceleration in Q3 led by the United States

• New store openings in Arizona and Tennessee

Europe

• Europe excluding France: +12%

• France alone: +9%

• Broad-based strength across all major European markets

Asia excluding Japan

• +4% growth

• Continued recovery in Greater China

• Store renovations and expansions in Bangkok, Taiwan, Macao, and Seoul supported performance

Middle East (Other region)

• +15% growth

• Maintained strong momentum

Leather Goods and Saddlery

• +13% growth

• Core growth engine of the group

• Strong demand for iconic bags and new models

• Expansion of production capacity with new leather workshops planned through 2028

Ready-to-wear and Accessories

• +6% growth

• Acceleration in Q3

• Strong reception of men’s and women’s collections shown in Paris and Hong Kong

Silk and Textiles

• +4% growth

• Supported by creative designs and premium materials

Perfume and Beauty

• -5% decline

• Impacted by tough comparison base from prior-year product launches

Watches

• -3% decline

• Still affected by challenging market conditions

• Product innovation continued

Jewellery and Home (Other Hermès sectors)

• +11% growth

• Strong demand for high jewellery and home collections

• Recurring operating margin: 41.4%

• Net profit margin: 28.0%

• Strong cash generation

• Net cash position above €10 billion

• Workforce continued to grow, reflecting long-term capacity investment

Revenue growth outlook

• Hermès reaffirmed its medium-term ambition for strong revenue growth at constant exchange rates

• No numeric guidance provided, consistent with Hermès’ conservative communication style

Strategic direction

• Continued focus on craftsmanship, controlled production, and exclusivity

• Ongoing investment in production capacity, especially leather goods workshops

• Balanced global distribution and selective store expansion

Risk and environment commentary

• Acknowledged economic, geopolitical, and currency-related uncertainties

• Management expressed confidence in navigating volatility due to integrated artisan

Management explicitly commented on early October trading and Q4 visibility.

• CFO said early October trends make management confident for Q4 despite a tougher comparison base

• Q4 comparison will be roughly €200 million tougher than Q3, but confidence remains “across all regions”

• This forward-looking confidence and Q4 color is not mentioned in the press release

The transcript clarified inventory strategy, which is not disclosed in the press release.

• Leather goods inventories were rebuilt in Q3

• Stock levels are now similar to last year to support year-end demand and Chinese New Year

• Management stressed delivery timing effects rather than demand weakness

Beyond generic “growth in Greater China,” management gave macro observations.

• CFO cited stabilization in real estate in tier-one Chinese cities

• Mentioned recovery in financial markets in mainland China and Hong Kong

• Golden Week early October trading was described as “quite strong and dynamic”

• Management cautioned against extrapolating but said signals were encouraging

The press release aggregates Asia ex-Japan, but the transcript breaks it down.

• Double-digit growth mentioned for Malaysia, Korea, and Australia

• Singapore and Thailand growth expected to be similar between Q3 and Q4

• This country-level color is not in the press release

Pricing guidance appeared only in Q&A.

• CFO stated 2026 price increases will be below 2025 levels

• Budget process still ongoing, no specific percentage provided

• Press release contains no pricing commentary

The transcript provided insight into who is buying, not just what is selling.

• Growth in Europe partly driven by US and Middle East travelers

• US demand described as broad-based, not limited to ultra-wealthy clients

• Jewelry, silk, shoes, watches all contributed to US growth

• Some divisions benefited from higher store footfall, especially in the US

Press release only mentions “high comparison base,” but transcript adds depth.

• Distributor stock reductions in Europe and the US impacted reported sales

• End-customer sales are still growing in key European countries

• Management confirmed skincare / care products are under development for post-2028

Longer-term capacity numbers were given verbally.

• Leather goods capacity growth expected at around +6% to +7% annually

• This pace expected to continue into 2026 and 2027

• Capacity expansion includes new workshops and extensions of existing sites

More granular store strategy was discussed on the call.

• Focus on fewer but larger stores, typically over 500 sqm

• 3–4 store openings per year plus ~15 renovation/expansion projects

• Major projects highlighted: Bond Street London flagship and Geneva expansion

This topic appears only in the transcript Q&A.

• Hermès confirmed it fully exited commercial activity in Russia

• All stores closed since the war began

• Only one location retained purely for legal and maintenance obligations

Management explained what is driving China improvement.

• Improvement driven by both slightly higher footfall and value strategy

• Value strategy means selling higher-priced items (larger jewelry, complicated watches)

• Management emphasized cautious optimism rather than strong recovery language

Hermès is quietly telling investors that business is steady, China is stabilising, inventory is under control, price hikes will slow, and growth will remain slow but very high-quality — without hype and without chasing volume.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com