-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Apple delivered a record breaking quarter, but the earnings call revealed additional strategic signals that were not fully visible in the press release. Below is a combined view of what the official results showed plus what management discussed during the call that gives deeper forward looking insight.

Table of Contents

Revenue reached about 143.8 billion dollars, up roughly 16 percent year over year. EPS reached about 2.84, up about 19 percent. This marked an all time record for both revenue and earnings per share.

The scale of profitability shows Apple is still operating at elite margin and efficiency levels even in a mixed global macro environment.

iPhone produced its best quarter ever with around 85 billion dollars revenue.

Management highlighted extremely strong global demand across all geographic regions.

The key takeaway is that flagship hardware cycles still drive ecosystem expansion and services monetization later.

Services generated about 30 billion dollars revenue and also hit an all time high.

The installed base now exceeds 2.5 billion active devices globally, which is critical because each device is a future services revenue opportunity.

This reinforces Apple’s transition from hardware only narrative to platform and recurring revenue story.

Operating cash flow was close to 54 billion dollars in one quarter.

Apple returned roughly 32 billion dollars to shareholders via dividends and buybacks.

Dividend was maintained at 0.26 dollars per share.

For long term investors, this confirms capital return remains a priority.

Earnings call discussion highlighted strong growth in Greater China and improving demand in emerging markets like India.

This matters because global saturation risk is often cited for Apple, and emerging market adoption helps extend growth runway.

Apple is experiencing supply constraints, particularly with advanced nodes for its system-on-chips (SoCs), impacting iPhone supply. CEO Tim Cook mentioned that the company is in “supply chase mode” and it’s challenging to predict when supply and demand will balance.

Management mentioned operating in supply chase mode for advanced chips.

This was not emphasized in the press release.

Translation: demand is currently stronger than supply in some product categories, which can support pricing power but can limit near term volume.

Apple is expanding its advertising services, including increasing ad slots in the App Store and exploring opportunities in other areas like maps and TV. With 2.5 billion active devices, the company sees significant potential for growth in its services business.

The call discussed expanding ad placements in areas like the App Store and potentially other ecosystem surfaces.

With billions of devices, even small ad monetization expansion could become a meaningful high margin revenue stream.

Apple announced a collaboration with Google to enhance its AI capabilities. This partnership aims to integrate intelligence across Apple’s operating systems in a personal and private manner, creating value and opening opportunities across products and services.

The call suggested collaboration approaches including external ecosystem partnerships to strengthen AI capabilities across Apple platforms.

This suggests Apple is prioritizing privacy plus integration rather than pure model race competition.

Significant growth was observed in emerging markets, especially in China and India. In Greater China, revenue grew 38% year-over-year, driven by record iPhone sales and a high number of new customers for Mac, iPad, and Apple Watch.

Apple reported high customer satisfaction rates in the U.S., with 99% for the iPhone 17 family, 98% for iPad, 97% for Mac, and 96% for wearables, according to 451 Research.

These insights provide a deeper understanding of Apple’s strategic focus areas and operational challenges beyond the financial metrics highlighted in the press release.

Investor summary

Bull case

Record device demand

Services scaling into recurring profit engine

Massive cash generation and shareholder return

Expanding monetization layers like ads and services

Watch closely

Supply chain constraints for advanced chips

China demand sustainability

Execution in AI platform competition

Services growth rate durability over next 3 to 5 years

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Trending Posts

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

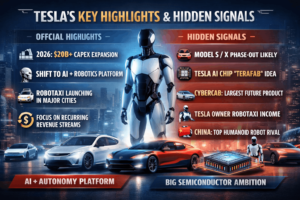

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com