-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Amazon’s Q4 2025 earnings showed strong growth on paper, but the real story comes from combining the press release with the earnings call transcript. The call provided deeper context around AI demand, AWS scale, infrastructure strategy, and long term capital allocation that did not fully appear in the official release. Below are the most important combined takeaways.

Below is a combined investor + strategic breakdown of what really matters.

Table of Contents

AWS reached roughly a 142 billion annualized revenue run rate while still growing over 20 percent. Growth at this scale is extremely difficult, and it shows AWS is expanding not just because of AI hype but because core cloud migration plus AI demand are both contributing.

Management made it clear that new AI capacity is being monetized almost immediately after deployment. This implies enterprise commitments and long term contracts are already signed before infrastructure is even fully online.

AWS backlog is around 244 billion and growing faster than revenue. This is a major forward indicator that enterprise cloud and AI workloads are still early in deployment cycles.

Amazon indicated they could grow faster if more compute and power were available. This means hyperscaler growth is constrained by infrastructure build speed rather than customer demand weakness.

Management described current AI demand as concentrated in two areas:

i. large AI labs spending heavily

ii. early enterprise productivity use cases

iii. The largest future wave is expected to come from full enterprise production workloads and new AI native business models.

The Rufus AI shopping assistant is not just experimental. Customers using Rufus are significantly more likely to complete purchases. This shows AI is already improving retail monetization, not just engagement.

Amazon disclosed more than 1000 internal AI applications across logistics, customer service, ads optimization, forecasting, and retail operations. This supports long term operating margin expansion through automation.

Amazon added massive power capacity over the last year and plans aggressive expansion through 2027. In the AI era, access to energy and compute density is becoming as important as software innovation.

Free cash flow declined mainly due to massive AI and infrastructure investment. Management expects strong long term returns on invested capital from these investments, similar to early AWS expansion cycles

Trainium and Graviton are already generating multi billion dollar revenue. Future chip generations are already planned. Amazon wants to control AI economics end to end rather than depend entirely on third party chip vendors.

The press release showed strong financial performance. The transcript revealed something bigger: Amazon is aggressively building the physical and software foundation layer of the AI economy. The company is prioritizing long term infrastructure dominance over short term margin optimization, which historically has been how Amazon built its largest businesses.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Trending Posts

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

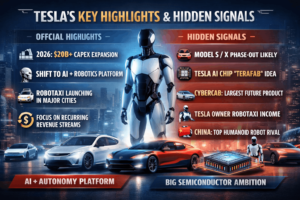

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com