-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

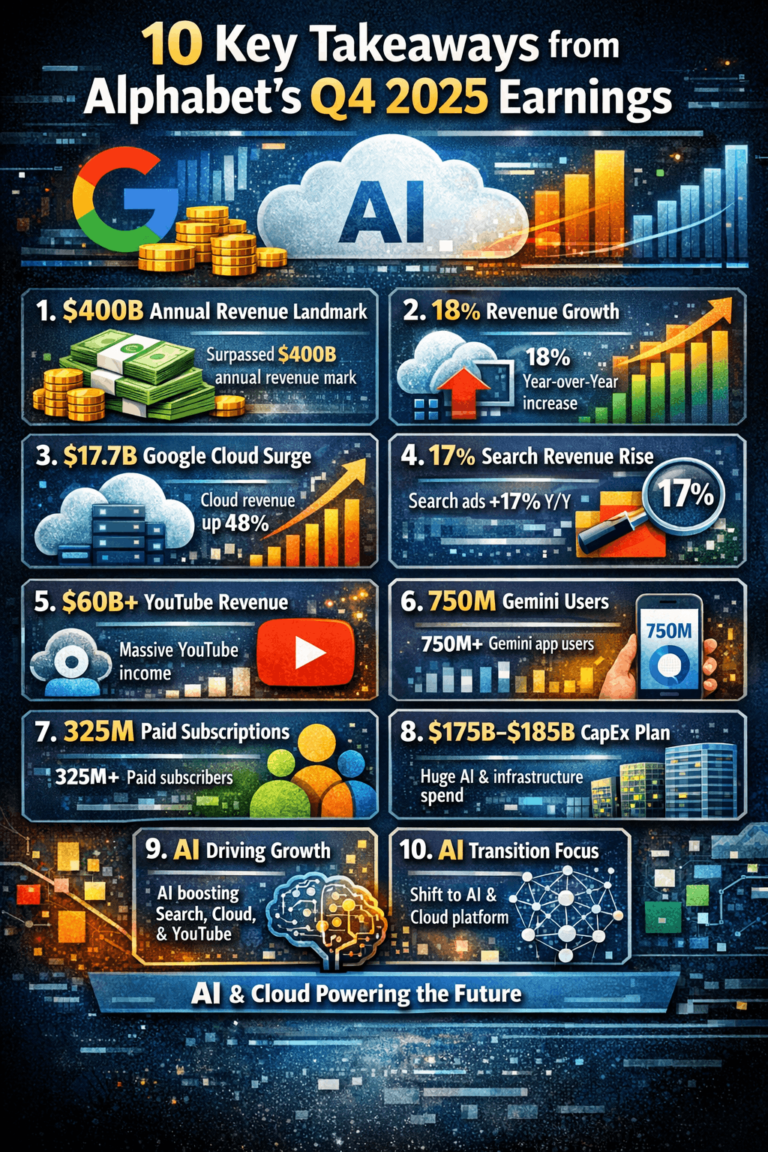

Alphabet ended 2025 with record-breaking results, fueled by strong performance across advertising, cloud, subscriptions, and artificial intelligence. The quarter confirmed that the company is entering a new phase where AI is not just experimental, but a direct revenue driver across its ecosystem.

Below are the most important insights from the quarter, explained in a practical, investor-focused way.

Table of Contents

Alphabet reported full-year 2025 revenue of about $402.8 billion, marking a historic milestone for the company. This shows the continued strength of its multi-engine model, where advertising, cloud, subscriptions, and AI all contribute to growth rather than relying on a single revenue source.

For long-term investors, crossing this scale level usually signals platform maturity and durable cash generation capacity.

Q4 revenue reached about $113.8 billion, growing roughly 18 percent year over year. Maintaining high-teen growth at this size is extremely difficult, which highlights how many growth levers Alphabet is now pulling simultaneously.

Net income rose about 30 percent year over year, while EPS increased about 31 percent. This suggests operating leverage is still strong even with large AI investments underway.

Google Cloud revenue grew about 48 percent year over year to roughly $17.7 billion in Q4. Growth was driven largely by enterprise demand for AI infrastructure, AI platforms, and model deployment.

Cloud is becoming Alphabet’s fastest-growing large segment and a direct beneficiary of enterprise AI adoption.

Search revenue grew about 17 percent year over year. This counters the narrative that AI chat interfaces are replacing search. Instead, AI is currently expanding usage and improving monetization efficiency.

YouTube generated more than $60 billion across ads and subscriptions in 2025. This makes it one of the largest media platforms globally and a key diversification pillar away from pure search advertising.

Alphabet’s Gemini ecosystem is already operating at enormous scale:

750 million plus monthly active users on the Gemini app

Over 10 billion tokens processed per minute through first-party models

This level of usage suggests AI is already deeply embedded into customer workflows and products.

Alphabet now has more than 325 million paid consumer subscriptions across Google One, YouTube, and other services. Recurring subscription revenue improves revenue predictability and margin stability over time.

Alphabet expects 2026 capital expenditures to be between $175 billion and $185 billion. This is an enormous investment cycle focused primarily on AI data centers, compute infrastructure, and global capacity expansion.

This will likely pressure near-term free cash flow but strengthens long-term competitive positioning.

Alphabet is transitioning from:

Search + Ads company

To

AI + Cloud + Platform + Ads ecosystem

AI is already driving growth across Search, Cloud, YouTube, and developer APIs. The company is positioning itself as a foundational infrastructure provider for the global AI economy.

Alphabet’s Q4 2025 results show a company successfully navigating one of the biggest technology transitions in decades. Advertising remains extremely strong, but the real long-term story is the scale of AI adoption and infrastructure investment.

The main investor debate going into 2026 will likely focus on whether AI-driven revenue growth can outpace the massive capital spending required to build global AI infrastructure.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

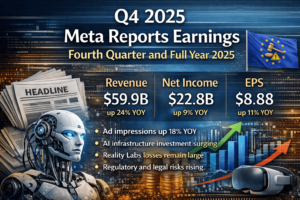

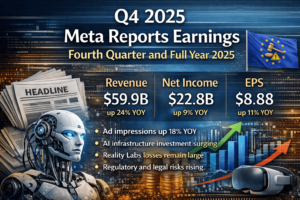

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Trending Posts

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

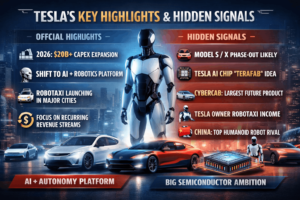

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com