-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

AMD closed 2025 with record financial performance and a major strategic shift toward AI infrastructure leadership. Beyond the headline numbers, the earnings results revealed how quickly AMD is transforming from a traditional CPU and gaming company into a core supplier for global AI compute.

Here are the most important insights from Q4 2025 and full year 2025 results.

Table of Contents

AMD generated roughly 10.3 billion dollars in Q4 revenue and about 34.6 billion dollars for the full year, both representing about 34 percent year over year growth.

Profitability also improved significantly, with strong operating leverage as high margin data center products became a larger share of revenue.

Data center revenue grew nearly 40 percent year over year in Q4, driven by EPYC server CPUs and Instinct AI GPUs.

This segment is now the most important long term driver of AMD’s valuation and growth narrative.

2025 marked the transition where AI acceleration products moved from early adoption into large scale deployment with hyperscalers, enterprises, and AI companies.

Management is clearly positioning AI as the dominant growth driver through the rest of the decade.

Unlike the narrative that AI is purely GPU driven, AMD highlighted strong demand for server CPUs because AI workloads still require massive CPU infrastructure for orchestration, data processing, and parallel workloads.

This creates a dual growth vector: CPU plus GPU.

Client and gaming revenue grew strongly in 2025, especially driven by Ryzen processor demand and gaming GPU demand.

However, management signaled potential macro pressure in the PC market going forward due to memory cost inflation and general demand normalization.

The console cycle is reaching later stages, which historically results in lower semi custom chip revenue.

AMD expects significant double digit decline in semi custom revenue in 2026 before next generation consoles ramp later in the decade.

As AMD sells more high performance data center and AI products, overall company margins are expanding.

Newer generation products typically start lower margin but improve significantly as volume and yield scale.

AMD emphasized multi year supply planning for key components like advanced packaging and memory.

This reduces risk of missing AI demand due to supply shortages, which has historically been a major issue across the semiconductor industry.

While AMD recorded some AI GPU sales into China in late 2025 and expects limited shipments in early 2026, management is not assuming meaningful long term China revenue.

This is an important geopolitical risk investors need to factor into forecasts.

Management is signaling confidence in multi year growth driven by AI and data center expansion, with ambitions that include:

Very high long term revenue growth potential

Major expansion of data center AI revenue scale

Significant long term EPS expansion driven by operating leverage

AMD’s 2025 results were not just strong financially. They showed structural business transformation. The company is rapidly becoming a central supplier to global AI infrastructure, with both CPU and GPU positioned as critical building blocks.

The biggest question going forward is execution. If AMD can deliver on its AI product roadmap and scale deployments with hyperscalers and enterprise customers, the company could sustain elevated growth rates well beyond the traditional semiconductor cycle.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Trending Posts

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

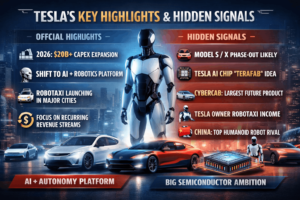

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com