-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Mastercard delivered another strong quarter – Q4 2025 on paper. Revenue, EPS, margins, and cross border growth all came in solid. But the earnings call revealed much deeper signals about where the company is heading strategically, technologically, and structurally over the next 3 to 5 years.

Below is a combined listicle covering both the official results plus the hidden signals management discussed during the call but were not fully explained in the press release.

Below is a combined listicle covering both the official results plus the hidden signals management discussed during the call but were not fully explained in the press release.

Table of Contents

What official results show

Revenue about 8.8B, up about 18 percent YoY

Adjusted EPS about 4.76, up about 25 percent YoY

Operating margin expansion to about 57.7 percent

Cross border volume growth about 14 percent

Switched transactions growth about 10 percen

What this really means

Core card rails remain extremely strong even before new growth engines are considered.

What transcript revealed

New multi year government grants signed late 2025

Expense benefit mainly 2025 to 2026

Other income benefit extending multiple years beyond 2026

Q4 alone improved expense growth by about 5.5 percentage points and added about 135M income impact

Why investors should care

This is a structural margin tailwind not obvious from headline results.

What transcript revealed

Management views stablecoins as another currency to settle across their network

Active partnerships across crypto ecosystem including settlement and wallet integrations

Press release gap

No detailed digital asset strategy positioning.

Strategic takeaway

Mastercard is trying to own the rails even if payment formats change.

What transcript revealed

AgentPay framework launched

Global issuer enablement underway

Working across AI ecosystem to embed payments into AI driven shopping journeys

Why it matters

If AI agents shop for consumers, payments still need identity, trust, and settlement. Mastercard wants to own that layer.

What transcript revealed

Consumers appear pessimistic in surveys but continue spending

Consumers becoming more optimized and reward driven in spending behavior

Press release gap

Only states spending is healthy.

Macro insight

Real transaction data still strong despite negative headlines.

What transcript revealed

Management does not see tariff impact in transaction level spending data

Strategic meaning

Consumer demand is more resilient than macro narratives suggest.

What transcript revealed

Strong opposition to Credit Card Competition Act

Concerns around cybersecurity risk and forced routing to cheaper networks

Concern that rate caps could reduce credit access

Press release gap

No regulatory tone included.

Why it matters

This is one of the largest long term risk factors to network economics.

What transcript revealed

Commercial payment volumes already about 13 percent of GDV

Growing double digits

Small business and invoice flows represent large conversion opportunity

Strategic meaning

Massive TAM expansion beyond consumer cards.

What transcript revealed

Transaction growth exceeding about 35 percent YoY

Why it matters

Positions Mastercard against remittance rails, not just card networks.

What transcript revealed clearly

More transactions → more data → more services → higher attach rate → higher revenue growth

Why it matters

Explains why services growth is consistently faster than payment network growth.

What transcript revealed

About 4 percent workforce impacted

About 200M restructuring charge expected Q1 2026

Goal is to free capacity for strategic growth investments

Press release gap

No workforce or restructuring scale discussion.

Strategic meaning

Classic shift from legacy areas into AI, services, and infrastructure.

What transcript revealed

Mastercard earns revenue from FX conversion services

Volatility can help or hurt depending on conditions

Why it matters

Creates partial natural hedge in global volatility environments.

What the press release says

Strong quarter, solid growth, stable margins.

What the transcript really says

Mastercard is preparing for the next era of payments where:

AI agents transact

Stablecoins settle

Services drive profit mix

B2B and money movement expand TAM

Regulation is the biggest long term external risk

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

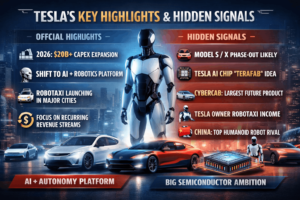

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Trending Posts

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com