-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

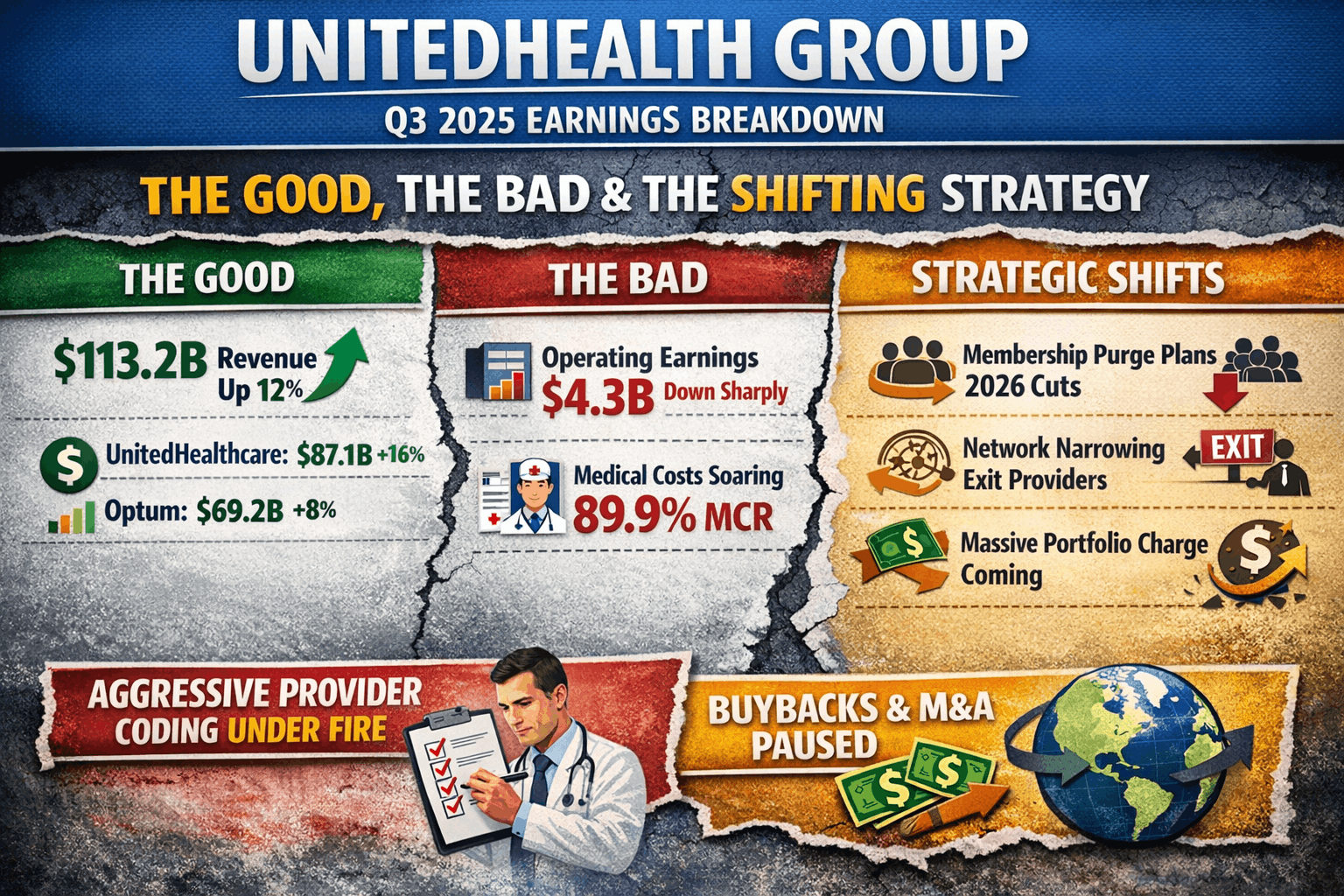

UnitedHealth Group (UNH) released its Q3 2025 earnings this week, and the headline numbers only tell half the story. While revenues are up, the company is quietly preparing for a massive strategic pivot. From “aggressive provider coding” to a planned membership purge, here is the breakdown of the good, the bad, and the strategic shifts revealed in the fine print.

Table of Contents

Let’s start with the official numbers. UNH delivered strong top-line growth, with Q3 revenues hitting $113.2 billion, a 12% increase year-over-year.

UnitedHealthcare: Grew 16% to $87.1 billion.

Optum: Grew 8% to $69.2 billion, largely driven by Optum Rx.

The Catch: Despite the revenue bump, operating earnings fell sharply to $4.3 billion (down from $8.7 billion last year). The company blamed this on the prior year’s cyberattack effects and significantly higher medical costs.

Potential Multi-Billion Dollar Charge: CEO Stephen Hemsley disclosed that the company is quantifying plans for portfolio rationalization which preliminarily imply a “non-GAAP, substantially non-cash, low single-digit billion-dollar charge” to be detailed in the Q4 call.

Optum Health “Course Correction”: Leadership admitted that Optum Health’s value-based care (VBC) strategy had “strayed from the initial intent” by growing networks too large and accepting risk for unsuited products.

Network Narrowing: The company is actively narrowing networks, separating from providers not aligned with their VBC model, and exiting underperforming PPO contracts.

While the press release noted growth, the transcript provided stark contraction forecasts for 2026 as the company prioritizes margin over volume:

Medicare Advantage (MA): The company expects a membership contraction of approximately 1 million members in 2026 due to plan exits, benefit adjustments, and competitive dynamics.

ACA (Individual Exchange): UHC filed for rate increases averaging over 25% and expects ACA enrollment to reduce by approximately two-thirds as they exit unsustainable service areas.

Optum Health VBC: Value-based care membership is expected to shrink by approximately 10% in 2026.

The Medical Care Ratio (MCR)—the percentage of premiums spent on medical claims—jumped to 89.9% (up from 85.2%).

While they cited regulatory cuts, leadership also pointed a finger at doctors. They blamed “aggressive provider coding and billing practices,” claiming that providers are upcoding visits to higher intensity levels and moving simple procedures to expensive sites like operating rooms to bill more.

Pause on Buybacks/M&A: CFO Wayne DeVeydt stated that share buybacks and strategic acquisitions are paused until the company returns its debt-to-capital ratio to around 40% (expected in the second half of 2026).

International Reduction: The company plans to reduce its footprint in international markets that do not align with serving U.S. healthcare needs.

Foundation Contribution: A significant portion of the operating cost increase was attributed to a $450+ million investment in employee incentives and the United Health Foundation, which was not detailed in the release.

Two interesting notes from the call that didn’t make the headlines:

Leaving Foreign Markets: UNH plans to reduce its footprint in international markets that do not align with U.S. healthcare needs.

Employee Spending: A significant chunk of their rising operating costs ($450+ million) went toward employee incentives and the United Health Foundation, signaling a move to stabilize their workforce and public image.

Specific AI Launches: The call highlighted new AI-first products not mentioned in the release, including “Optum Real” (real-time claims), “Optum Integrity One” (AI auto-coding with 73% productivity gains in ambulatory claims), and “Crimson AI” (clinical analytics).

Revenue: Q3 2025 revenues reached $113.2 billion, a 12% increase year-over-year.

Earnings Per Share (EPS):

GAAP EPS: $2.59.

Adjusted EPS: $2.92.

Operating Earnings: Earnings from operations were $4.3 billion, compared to $8.7 billion in the prior year. This decrease was significantly impacted by elevated medical cost trends and the prior year’s Change Healthcare cyberattack.

Cash Flow: Cash flows from operations were $5.9 billion, representing 2.3x net income.

Outlook: UNH raised its full-year 2025 earnings outlook to net earnings of at least $14.90 per share and adjusted net earnings of at least $16.25 per share

UnitedHealthcare:

Revenues grew 16% year-over-year to $87.1 billion.

Domestic consumers served increased by 795,000 to 50.1 million.

Operating earnings were $1.8 billion, down from $4.2 billion in Q3 2024, primarily due to elevated medical costs, Medicare funding reductions, and Inflation Reduction Act (IRA) impacts.

Optum:

Revenues grew 8% year-over-year to $69.2 billion.

Optum Rx revenue increased 16% to $39.7 billion, driven by growth in script volumes and pharmacy services.

Optum Health revenue was flat at $25.9 billion, with operating earnings of $255 million.

Optum Insight revenue was flat at $4.9 billion, with operating earnings of $706 million.

Medical Care Ratio (MCR): The MCR was 89.9%, up from 85.2% in the prior year. This increase was driven by elevated cost trends (particularly in physician and outpatient care), Medicare funding reductions, and the IRA’s impact on Part D seasonality.

Operating Cost Ratio: The ratio was 13.5%, reflecting investments to support future growth.

Return on Equity: Reported at 26.3% for the quarter.

Liquidity: The debt-to-capital ratio stood at 44.1% as of September 30, 2025.

Medical Cost Pressures: The company observed increased care patterns, particularly for physician and outpatient care, which were above pricing expectations for 2025.

Regulatory Impacts: Results were influenced by Medicare funding reductions and changes to the Part D program under the Inflation Reduction Act.

Cyberattack Comparison: Prior year comparisons were skewed by the impacts of the Change Healthcare cyberattack in 2024.

The transcript offered specific percentage forecasts for medical cost trends that were not in the release:

MA Trend Figures: They forecast full-year 2025 MA trend at approximately 7.5% and are pricing for a 10% trend in 2026.

Medicare Supplement: Trends are exceeding 11%.

Aggressive Provider Coding: Leadership explicitly blamed “aggressive provider coding and billing practices” for elevated costs, citing higher service intensity per encounter and shifts to higher-cost sites of service (e.g., labs, surgery) and higher DRG coding.

The Bottom Line: UnitedHealth Group is entering a transition year. They are willing to shrink their customer base and take a massive financial charge now to secure higher margins in 2027. For investors, the raised 2025 outlook ($14.90+ EPS) is a comfort, but 2026 is shaping up to be a year of “cleaning house.”

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Alphabet Q3 2025 Earnings: What the Slides Miss and the Transcript Reveals About AI Growth

Trending Posts

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Alphabet Q3 2025 Earnings: What the Slides Miss and the Transcript Reveals About AI Growth

Microsoft FY25 Q3 Earnings: Why Azure and AI Are Stronger Than The Numbers Show

NVIDIA Q3 FY2026 Earnings: What the Slides Did Not Tell You About the AI Supercycle

NVIDIA CES 2026 Highlights: Robots, AI Agents and the Vera Rubin Supercomputer

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com