-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

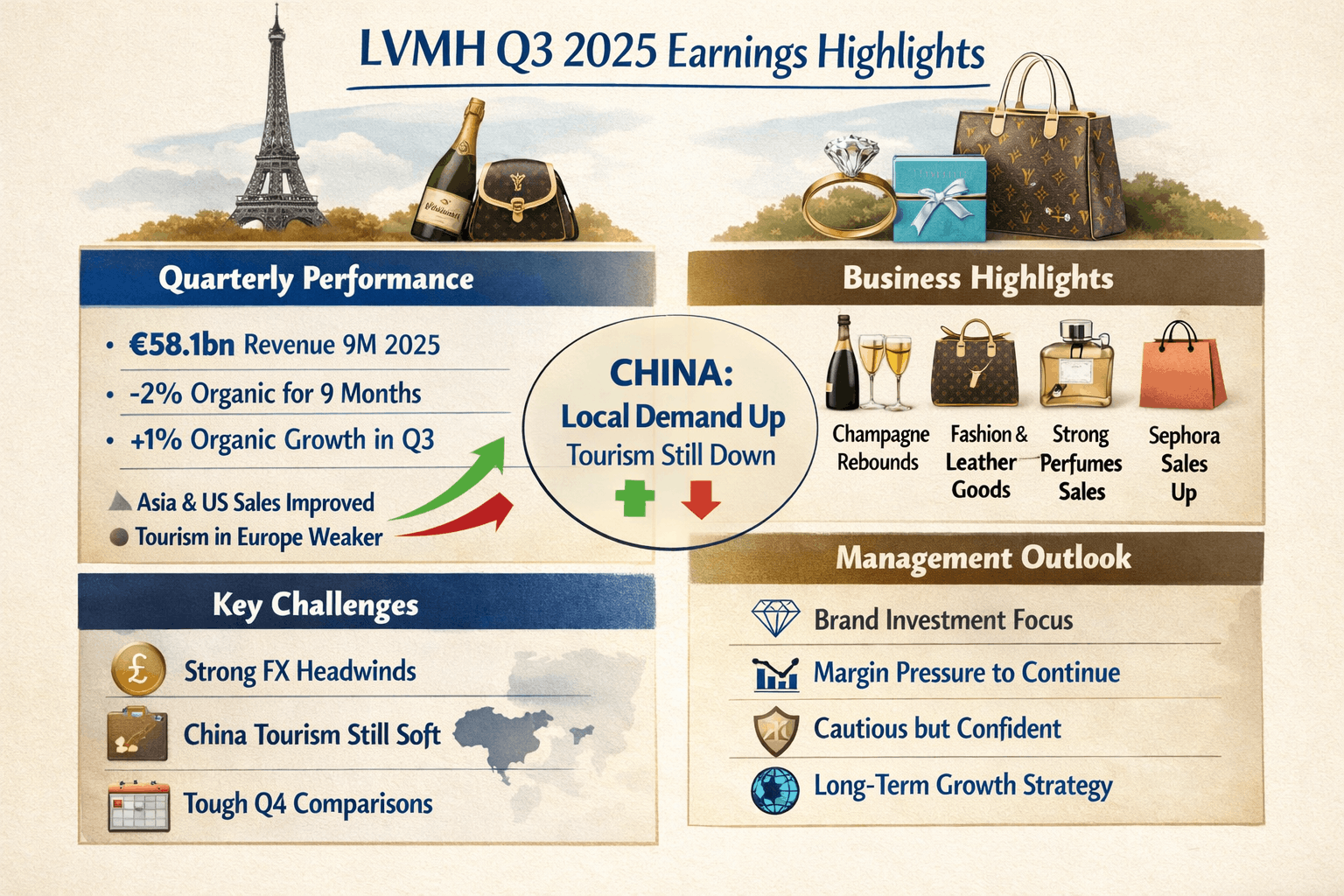

LVMH’s latest earnings release, presentation slides, and earnings call all tell the same story, but at very different levels. The official materials show resilience and improvement, while the earnings call explains what is really happening behind the scenes. Here is the full picture in simple terms.

Table of Contents

For the first nine months of 2025, LVMH revenue was about €58 billion, slightly lower than last year. However, the third quarter itself returned to growth. This is important because it shows the business stopped getting worse and has started to recover.

Management highlighted that nearly every business division and most regions improved in Q3. The only real weak spot was Europe, where tourist spending fell due to currency effects. This broad-based improvement is why management sounded more confident.

A strong euro reduced reported sales by about 5% in Q3 alone. Management made it clear that currency was one of the biggest reasons headline numbers look weak. Without this, growth would appear much healthier.

One key point from the earnings call is that LVMH did not rely on raising prices. Sales improved mainly because more people visited stores and bought products. Prices and product mix were mostly unchanged versus the previous quarter.

Customers inside mainland China are now buying more again. However, Chinese tourists shopping overseas are still spending much less than before. Combined, China is still slightly negative, but management sees clear signs that the worst is likely over.

Southeast Asian customers improved even without easy comparisons from last year. This suggests demand is truly getting better, not just benefiting from accounting effects.

The US returned to positive growth in Q3, driven mainly by local demand. Champagne also performed well, although management noted some of this was helped by distributors restocking inventory.

Japan sales are down compared with last year, but management explained this is due to very tough comparisons. Last year was boosted by heavy tourist spending caused by a weak yen. Quarter to quarter, Japan is actually improving.

This is LVMH’s largest and most important division. Sales are still down year on year, but the decline slowed in Q3. Management attributed this to better execution, strong local customers, and renewed excitement around key brands like Louis Vuitton and Dior.

The Louis Vuitton “ship” store in Shanghai is not meant to generate huge direct revenue. Instead, it creates excitement, traffic, and brand attachment, which later translates into sales. Management sees it as brand building rather than a normal store.

Selective Retailing, driven by Sephora, was one of the strongest parts of the group. Sephora gained market share, delivered solid growth, and launched new brands successfully. Management repeatedly highlighted Sephora as a stabilizing force.

Champagne and wines improved and returned to growth in Q3. Cognac remains weak due to trade tensions and softer demand in the US and China. This split explains why the division looks mixed overall.

LVMH said it will continue to invest in brand quality, innovation, retail excellence, and talent. Management does not plan to cut investment just to protect short-term margins, even in a difficult economic environment.

Management clearly stated that cost control alone cannot fix margins. As long as overall sales are still down year on year, margins will remain pressured. A return to growth is necessary for margins to stabilize.

Management warned that Q4 comparisons will be harder than Q3 because last year’s numbers were strong. This does not mean demand is falling again, but headline growth may look worse.

While currency already hurt revenue in Q3, management said FX could have an even bigger negative impact on margins in Q4, although hedging will partly offset this.

Despite geopolitical and economic uncertainty, LVMH said it remains confident in its strategy and expects to reinforce its global leadership in luxury goods. No major financial or structural risks were identified.

When management talks about “self-help,” it does not just mean hiring new designers. It includes better store concepts, flagship openings, selective product launches, retail innovation, Sephora growth, and improving customer experience across brands.

LVMH is not booming yet, but it is clearly improving. Real customer demand is coming back, brands remain strong, and management is investing for the long term. Short-term numbers are still distorted by currency and tough comparisons, but the foundation for recovery is being rebuilt.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com