-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

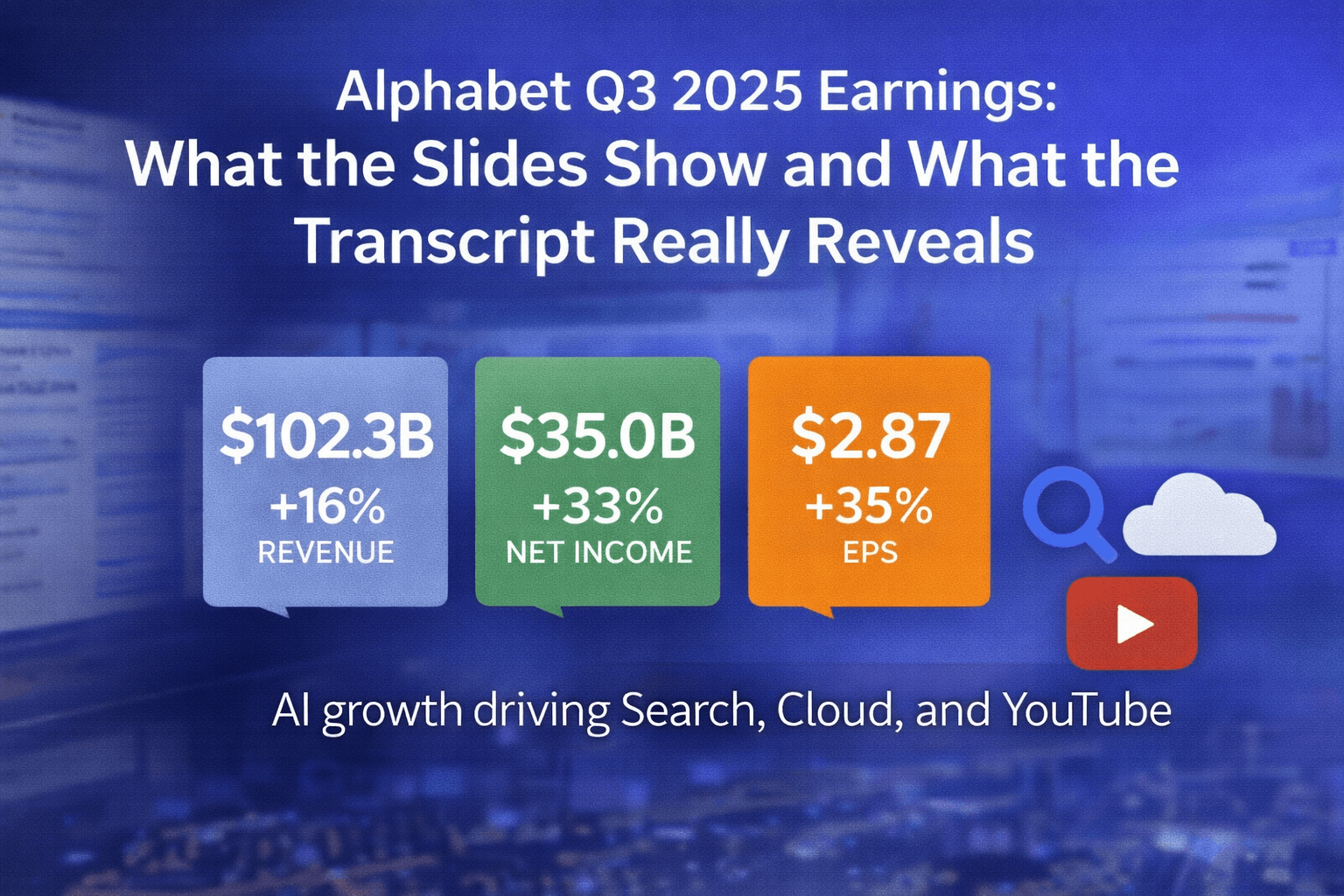

Alphabet delivered a landmark quarter in Q3 2025, reporting its first-ever revenue quarter above USD 100 billion. While the earnings presentation highlighted strong financial growth across Search, YouTube, and Cloud, the earnings call transcript revealed deeper strategic signals that are not visible in the slides alone. Here’s a complete picture of where Google is heading.

Table of Contents

Alphabet reported consolidated revenue of USD 102.3 billion, up 16 percent year over year, with net income rising 33 percent and earnings per share increasing to USD 2.87. Growth was broad-based, with Google Services, YouTube Ads, Subscriptions, and Google Cloud all delivering double-digit expansion. Google Cloud stood out with 34 percent revenue growth and a sharp improvement in operating margin, reflecting better scale and efficiency

Beyond the financials, management emphasized that AI is now changing user behavior at scale. AI Overviews and AI Mode are not simply replacing traditional Search queries but expanding total search activity. AI Mode alone has surpassed 75 million daily active users, and management disclosed that queries in AI Mode doubled quarter over quarter. This level of engagement was not shown in the slides but signals a structural expansion in how users interact with Google.

A key reassurance for investors came directly from the transcript. Management repeatedly stated that AI Overviews are monetizing at approximately the same rate as traditional Search at the current baseline. This directly addresses market concerns that AI-driven answers could dilute advertising economics. While the slides only show aggregate Search revenue growth, the call clarified that AI has not weakened monetization.

Another important nuance missing from the slides is that advertising in AI Mode is still in an early testing phase. Google is deliberately testing and learning before expanding ads further. This suggests that current Search revenue growth does not yet reflect the full monetization potential of AI Mode, leaving room for future upside rather than signaling saturation.

The presentation showed Google Cloud revenue growth and a record backlog, but the transcript went further. Management stated clearly that Cloud demand continues to exceed available capacity, particularly for AI infrastructure. This tight demand-supply environment is expected to persist into 2026 despite aggressive investment. Cloud backlog reached USD 155 billion, driven largely by enterprise AI demand, and Google has already signed more billion-dollar Cloud deals in the first nine months of 2025 than in the prior two years combined.

While the slides grouped Cloud growth at a high level, the earnings call revealed that enterprise AI products are already generating billions of dollars in quarterly revenue. This confirms that AI is not just a long-term bet but a material revenue contributor today, particularly through GCP, custom TPUs, GPUs, and Gemini-based enterprise solutions.

One of the most overlooked highlights from the transcript was how AI is improving Google’s own operations. Management disclosed that nearly half of Google’s internal code is now generated with AI assistance. Gemini-powered tools have increased sales productivity by over 10 percent and contributed hundreds of millions in incremental revenue. These efficiency gains are invisible in the slides but help explain margin resilience despite rising infrastructure costs.

The slides showed strong YouTube revenue growth, but the call explained the underlying mechanics. YouTube Shorts now generate more revenue per watch hour than traditional in-stream ads in the US, and Shorts carry a lower revenue share, supporting margin improvement. At the same time, subscriptions such as YouTube Premium and YouTube Music continue to grow, with subscribers generating higher lifetime value than ad-supported users. Management described YouTube as a twin-engine model powered by both ads and subscriptions.

Waymo did not appear in the earnings slides, but the transcript included meaningful strategic updates. Waymo plans to expand services to London and Tokyo, scale operations in multiple US cities, and has secured approval for fully autonomous airport operations in San Jose and San Francisco. Management also hinted at future integration between Waymo and Gemini, pointing to a more personalized and AI-driven mobility experience in 2026.

Alphabet raised its 2025 capital expenditure guidance to USD 91–93 billion, primarily for AI infrastructure. More importantly, management explicitly signaled that capital spending will increase significantly again in 2026, with more details to be shared in future calls. This forward-looking signal does not appear in the slides but is critical for long-term valuation and cash flow modeling.

The earnings slides tell a story of strong financial execution. The transcript tells a deeper story of expanding user behavior, monetization resilience, structural AI-driven growth, and long-term strategic positioning. Together, they show that Alphabet is not just growing revenues but reshaping how Search, Cloud, and media operate in an AI-first world.

For investors and business observers, the most important signals are not just what Google earned this quarter, but how confidently management is describing AI as both an expansionary force and a durable monetization engine across the entire ecosystem.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com