-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Microsoft just reported one of the most important quarters in its history. On the surface, FY25 Q3 looked strong: revenue grew 13 percent, cloud grew 20 percent, and Azure grew over 30 percent. But if you only read the earnings slides, you miss the real story.

The real signal was hidden inside the earnings call transcript. When you combine the slides with what Satya Nadella and Amy Hood actually said, you realize something much bigger is happening.

Microsoft is no longer just growing. It is becoming the core infrastructure of the global AI economy.

Table of Contents

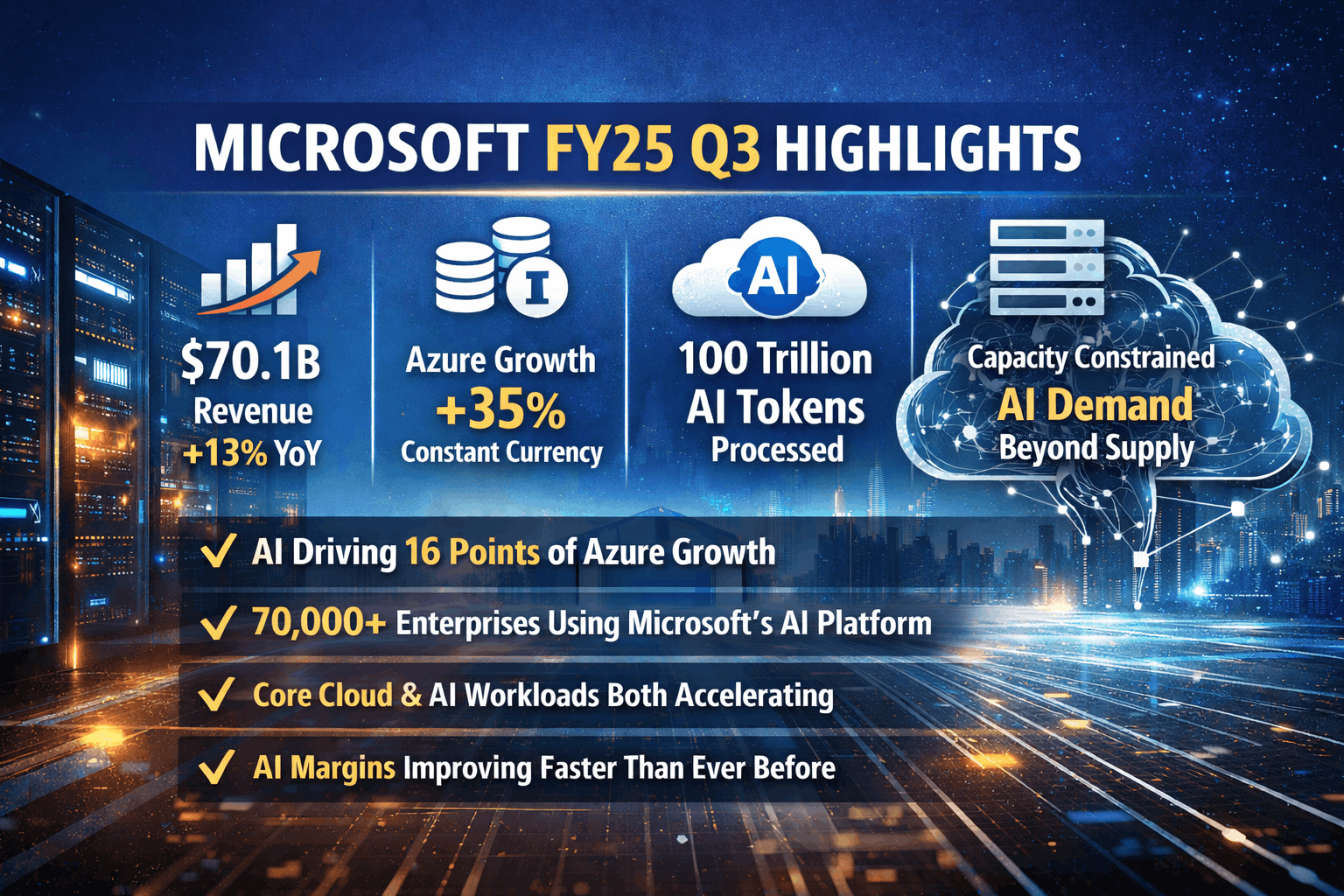

Microsoft reported revenue of 70.1 billion for FY25 Q3, up 13 percent year over year. Operating income rose 16 percent to 32.0 billion, while net income increased 18 percent to 25.8 billion. Earnings per share came in at 3.46, also up 18 percent.

Microsoft Cloud revenue reached 42.4 billion, growing 20 percent year over year and 22 percent in constant currency. Azure growth remained above 30 percent, reaching 33 percent reported and 35 percent in constant currency.

On their own, these numbers confirm Microsoft remains one of the strongest large-cap technology companies in the world. However, they do not explain why management continues to invest aggressively or why long-term expectations continue to rise.

The slides say Azure will grow 34 to 35 percent next quarter. That sounds great. But the transcript reveals something far more powerful.

Microsoft is actually supply constrained.

Satya Nadella openly stated that Microsoft is short of data center power in specific regions and cannot bring capacity online fast enough to meet demand. Amy Hood confirmed that Microsoft expected to be in balance by the end of Q4 but now expects to remain tight even after June.

This means Microsoft is not guiding conservatively. It is physically unable to serve all customer demand for AI today.

That is one of the strongest demand signals any cloud company can give.

Amy Hood made another critical disclosure.

AI demand is now growing faster than Microsoft’s data center buildout. As a result, Microsoft expects AI capacity constraints beyond June.

This is crucial for investors.

It means FY25 guidance is not a demand ceiling. It is a supply ceiling. There is real upside pushed into FY26 simply because Microsoft cannot build fast enough.

Most investors assume Azure growth is now almost entirely AI driven.

The transcript reveals something very different.

Amy Hood explained that most of Azure’s upside this quarter came from non-AI workloads, not AI. Enterprise cloud migrations, data platforms, and core compute workloads all accelerated again.

AI growth was strong, but the real surprise was that classic cloud came back to life at the same time.

This is what makes Microsoft uniquely powerful.

It is not just selling GPUs. It is pulling entire IT estates, databases, analytics platforms, and enterprise workloads into Azure at the same time.

Microsoft also revealed something that never appears in the slides.

Of Azure’s roughly 33 to 35 percent growth, 16 percentage points came directly from AI services.

That means nearly half of Azure’s growth is now AI driven.

Without AI, Azure would still be growing in the high teens or low twenties. With AI, it is now accelerating into the mid-30s.

This is a structural shift, not a temporary spike.

Microsoft did not just talk about revenue. It disclosed usage.

This quarter alone, Microsoft processed more than 100 trillion AI tokens. That is five times higher than last year. In one single month, it processed 50 trillion tokens.

These are not demos or pilots. These are production workloads running at global scale.

The transcript revealed adoption numbers that never appear in the slides.

More than 70,000 enterprises are using Microsoft Foundry to build AI applications and agents.

Over 10,000 organizations are using Agent Service to deploy AI agents.

GitHub Copilot now has more than 15 million users.

Power Platform has 56 million monthly active users.

Copilot Studio has been used by 230,000 organizations, including 90 percent of the Fortune 500.

One million custom AI agents were created in just one quarter.

This is not a future product. It is already a global operating system for AI.

One of the most important strategic comments came from Amy Hood.

She said it is getting harder and harder to separate AI workloads from non-AI workloads. GPUs, CPUs, storage, databases, and networks are all used together.

This means when customers adopt AI on Azure, they also adopt databases, data lakes, analytics, networking, and compute on Azure.

AI is not replacing the cloud. It is supercharging it.

Investors worry about AI margins because of massive capex.

Microsoft addressed this directly.

Amy Hood said the AI business is already more profitable at this stage than Azure was at the same stage in the original cloud transition.

That means Microsoft is not burning money on AI. It is building a more efficient hyperscale platform than it did a decade ago.

Microsoft is not just reporting good numbers.

It is quietly telling the market that:

AI demand exceeds supply

Azure is accelerating from both AI and classic cloud

AI is pulling entire enterprise workloads into Azure

Usage is exploding at real, production scale

The platform is already massively adopted

Margins are structurally improving

The FY25 Q3 quarter was not just strong.

It was the beginning of Microsoft becoming the default operating system for the AI economy.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

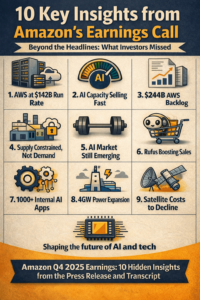

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

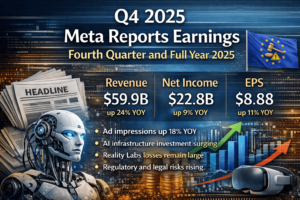

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com