-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Table of Contents

a. Group revenue

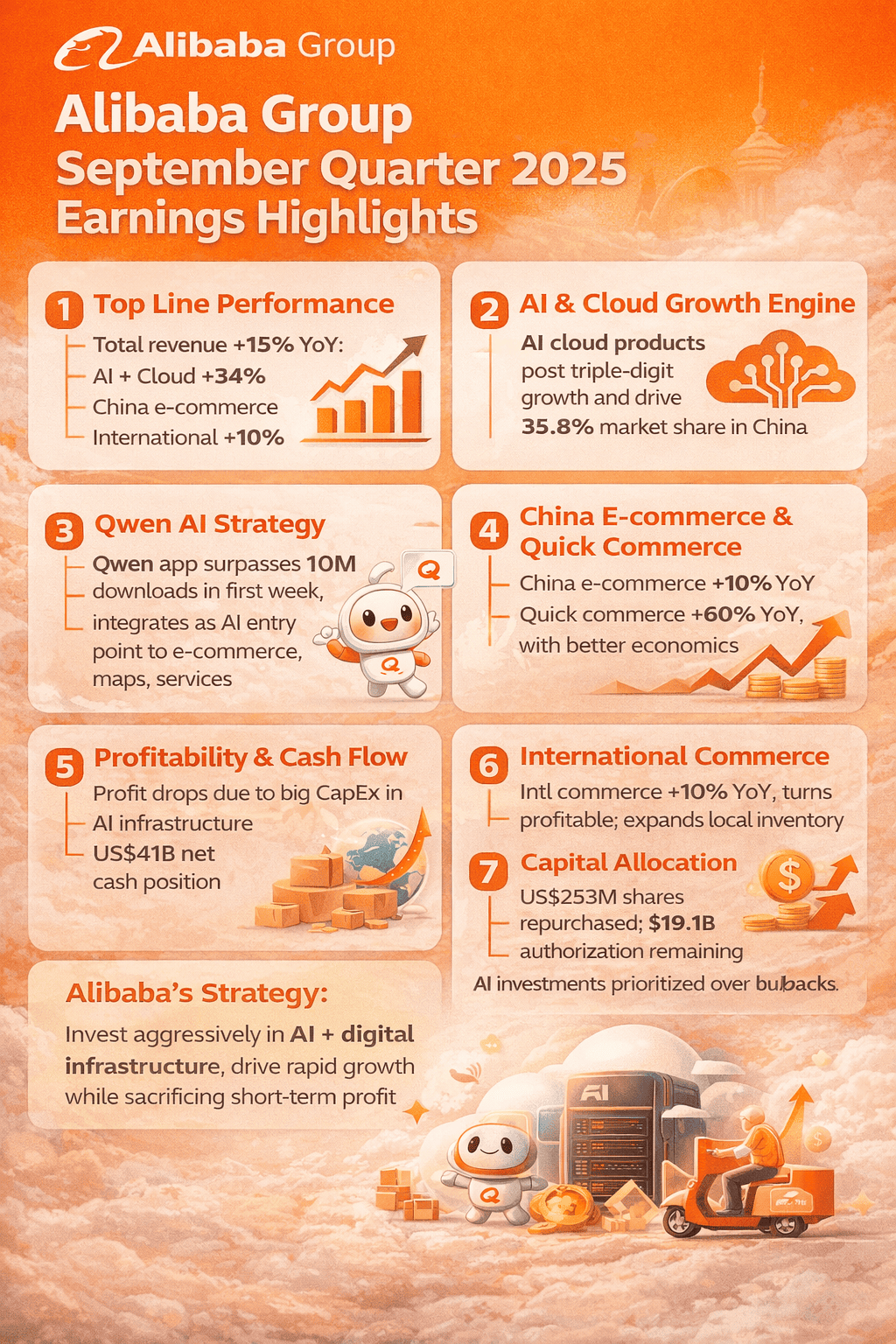

On a like-for-like basis excluding disposed businesses (Sun Art and Intime), total revenue grew 15% year over year.

b. By segment

Alibaba China E-commerce Group: +16%

Cloud Intelligence Group: +34%

Alibaba International Digital Commerce Group (AIDC): +10%

Alibaba is now driven by two core engines: AI plus Cloud, and Consumption.

a. Cloud revenue

Cloud Intelligence Group revenue reached RMB 39.8 billion, growing 34% year over year.

Revenue from external customers grew 29%.

b. AI monetisation

AI-related cloud products continued to grow at a triple-digit rate and now account for more than 20% of cloud revenue from external customers.

c. Market leadership

Alibaba Cloud is the clear leader in China’s AI cloud market with a 35.8% market share, larger than the combined share of the next three competitors.

d. Management outlook

Customer demand for AI is growing faster than Alibaba can deploy servers. Order backlog is expanding, and management stated that the previously announced RMB 380 billion three-year capital expenditure plan may prove too small given current demand.

The Qwen consumer AI app exceeded 10 million downloads within its first week of public beta.

Alibaba is positioning Qwen as a core AI entry point for e-commerce, maps, local services, and lifestyle apps, creating an AI-powered super-app rather than a standalone chatbot.

a. Core e-commerce

Customer Management Revenue, the key monetisation metric for Taobao and Tmall, grew 10% year over year.

b. Quick commerce

Quick commerce revenue rose 60% year over year, driven by Taobao Instant Commerce and Ele.me.

Around 3,500 Tmall brands have already connected their offline stores to Alibaba’s quick commerce network.

c. Unit economics

Since mid-year, per-order losses in quick commerce have been cut by half due to higher average order value, better order mix, and lower delivery cost per order.

Adjusted EBITA declined 78% year over year.

GAAP net income fell 53% year over year.

Free cash flow was –RMB 21.8 billion for the quarter.

This decline was driven by aggressive investments in AI infrastructure and quick commerce logistics, not by weak demand.

Alibaba ended the quarter with approximately US$41 billion in net cash, giving it strong financial flexibility.

Alibaba International Digital Commerce Group revenue increased 10% year over year to RMB 34.8 billion.

The segment turned profitable on an adjusted basis, with adjusted EBITA of RMB 162 million.

AliExpress is expanding local inventory in more than 30 countries and rolling out programs to help Chinese brands sell overseas.

Alibaba repurchased US$253 million of shares during the quarter.

Remaining buyback authorization stands at US$19.1 billion through March 2027.

At the same time, management signaled that AI infrastructure investment is now the top priority due to global shortages of GPUs and AI servers.

Alibaba is deliberately sacrificing short-term profitability to lock in leadership in AI cloud, consumer AI, and on-demand retail.

With cloud growth at 34%, AI products growing at triple-digit rates, and quick commerce scaling rapidly, Alibaba is positioning itself as a full-stack AI and digital commerce platform rather than just an e-commerce company.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

Trending Posts

FCT 1Q FY26 Earnings Highlights: Stable Traffic, 99.9% Occupancy and AEI Growth Pipeline

VICOM FY2025 Earnings Highlights: 12 Key Takeaways for Investors

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com