-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Starbucks’ Q1 FY2026 earnings showed improving comparable sales, positive transaction recovery, and early turnaround momentum. While margins remain under pressure due to labor and cost investments, management reaffirmed full-year guidance and said the turnaround is ahead of schedule.

Below is a quick snapshot of the key Q1 FY2026 results before diving into what management revealed on the earnings call.

Table of Contents

Starbucks (SBUX) Q1 FY2026 Earnings Highlights Snapshot

Key Financial Performance

| Metric | Q1 FY2026 Result |

|---|---|

| Revenue | USD 9.9B (+6% YoY) |

| Global Comparable Sales | +4% |

| U.S. Comparable Sales | +4% |

| China Comparable Sales | +7% |

| Non-GAAP Operating Margin | 10.1% |

| GAAP EPS | USD 0.26 |

| Non-GAAP EPS | USD 0.56 |

Customer & Demand Trends

| Metric | Result |

|---|---|

| Global Transactions | +3% |

| Average Ticket | +1% |

| U.S. Active Rewards Members | 35.5M |

Segment Performance

| Segment | Revenue | Comp Sales | Margin |

|---|---|---|---|

| North America | USD 7.3B | +4% | 11.9% |

| International | USD 2.1B | +5% | 13.7% |

| Channel Development | USD 523M | — | 41.3% |

Store & Strategy

| Category | Result |

|---|---|

| Net New Stores | +128 |

| Global Store Count | 41,118 |

| Key Strategy | Back to Starbucks turnaround |

FY2026 Guidance Snapshot

| Metric | Guidance |

|---|---|

| Comparable Sales Growth | ≥3% |

| Revenue Growth | In line with comps |

| Margin | Slight improvement expected |

| EPS | USD 2.15 – 2.40 |

| New Stores | 600 – 650 |

Key Guidance Context

• Margin recovery expected to lag revenue recovery

• China expected to remain company-operated in H2 FY2026

• Cost pressure from labor, coffee prices, and tariffs continues near term

Management made it explicit: the priority is rebuilding transactions and top-line growth first, then margins and EPS will follow.

This sets expectations that profitability recovery will lag revenue growth during the turnaround.

For the first time since FY2022:

• Rewards customer transactions are growing

• Non-rewards customer transactions are growing faster

This shows brand relevance is expanding beyond loyalty members.

Management revealed only about 0.5 percentage points of comp growth came from sales transferring from closed stores.

Most growth is coming from real demand recovery.

About 650 pilot stores are outperforming the system by roughly 200 basis points in comps.

This strongly validates the operating model change.

Management disclosed a multi-year program targeting around $2B in savings across:

• G&A

• Procurement

• Technology-driven efficiency

This was not quantified in the press release.

Starbucks simplified the menu significantly to improve speed, training, and consistency.

This is a major structural operating change.

Instead of one-off products, Starbucks is building repeatable innovation platforms:

• Health and wellness (protein)

• Personalized energy drinks

• Premium artisanal bakery

Management said protein drinks are bringing in new visits and showing strong repeat rates.

This suggests incremental demand, not just mix shift.

Starbucks defined customer behavior clearly:

Morning = routine ritual

Afternoon = reset moment

Expect more innovation around energy drinks, snacks, and indulgent beverages.

Systemwide digital menus will allow real-time merchandising by time of day.

This is a major future revenue lever.

Starbucks is rolling out multiple prototype formats designed to reduce build cost and improve returns while supporting full channel access (café + drive-thru + mobile).

Management said peak performance is improving, but the real goal is sub-4-minute service across the full day.

Management gave timing guidance:

Cost pressure expected to ease in the second half of FY2026.

The China joint venture structure could be about 40 basis points margin accretive long term, even if near-term revenue declines.

Management said marketing will remain structurally higher, funded partly by reducing discounting.

This signals confidence in brand strength vs promo-driven traffic.

What This Means For Investors

The transcript shows Starbucks is not just trying to boost short-term sales.

The company is rebuilding its entire operating system:

• Simplified menu

• Faster service

• Stronger brand positioning

• Technology-enabled labor efficiency

• New store economics

• Platform-based product innovation

This is a multi-year operational transformation, not a quick earnings rebound story.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

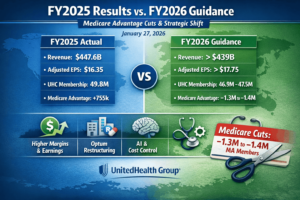

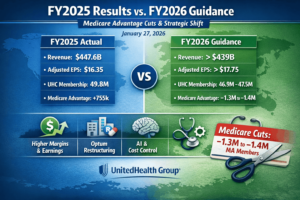

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

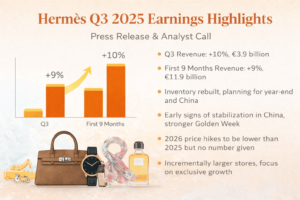

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com