-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Tesla’s latest earnings release showed a company in transition. The official update focused on financial performance, AI progress, and product roadmap execution. However, the earnings call revealed deeper strategic signals about Tesla’s long-term direction, capital allocation, and business model transformation.

Below is a combined view of both the official highlights and the more subtle messages revealed during the earnings call.

Table of Contents

Official materials emphasized Tesla’s evolution toward AI, autonomy, robotics, and software-driven revenue. Management highlighted continued investment in FSD, Robotaxi, Optimus robots, and AI infrastructure.

The earnings call went further, framing Tesla’s long-term mission around an AI-driven abundance economy powered by robotics and automation.

This signals Tesla wants to be valued closer to an AI infrastructure company than a traditional automaker.

Financial updates confirmed strong cash generation and balance sheet strength, but the call revealed aggressive capital deployment plans.

Management expects capital expenditure to exceed 20 billion, tied to multiple new factories including Cybercab, Semi, Optimus, battery supply chain, and AI compute expansion.

This indicates Tesla is entering an infrastructure build phase rather than optimizing near-term margins.

Official updates highlighted FSD subscription growth and services expansion.

The call introduced a stronger narrative: Tesla aims to generate long-term revenue from autonomy software, robotaxi fleet utilization, and AI-enabled services instead of relying mainly on vehicle sales.

This is closer to a transportation platform or cloud-style recurring revenue model.

Official materials mention robotaxi rollout and early deployments.

The call confirmed unsupervised robotaxi rides are already happening in Austin and the fleet is expected to scale rapidly across cities as regulations allow.

Management expects autonomy coverage to expand significantly across the United States over time.

The call suggested production of Model S and Model X could be wound down, with factory capacity redirected to Optimus robot production.

Long term, Tesla expects autonomy-focused vehicles and robotics to dominate output.

This is a major symbolic shift away from traditional luxury EV positioning.

Management stated long-term Cybercab production could exceed all other Tesla vehicles combined, reflecting a belief that most transportation will become autonomous.

If correct, Tesla’s total addressable market expands from car buyers to global mobility demand.

Rather than demand or competition, management suggested AI chip supply and memory availability may limit Tesla growth in 3 to 4 years.

This explains Tesla’s aggressive push into chip design and supply chain control.

The call introduced the idea of a Tesla “Terafab” to manufacture AI chips, memory, and packaging domestically to reduce supply chain risk and geopolitical exposure.

This would represent a major expansion into semiconductor infrastructure.

Management discussed a future where Tesla owners could add vehicles to the robotaxi fleet and potentially earn income, similar to a mobility marketplace model.

This could radically change vehicle ownership economics.

Management explicitly stated China will likely be Tesla’s strongest competitor in humanoid robotics due to manufacturing scale and improving AI capability.

Short term story

Heavy investment cycle

Margin pressure possible

Execution risk around autonomy and robotics

Long term story

AI + autonomy platform

Robotics manufacturing scale

Infrastructure-level vertical integration

Recurring mobility and software revenue

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

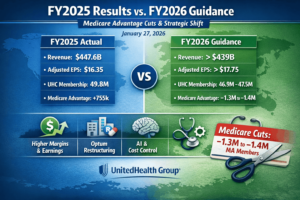

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

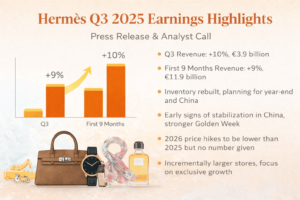

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com