-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Copart’s Q2 fiscal 2026 results showed year-over-year declines in revenue and earnings. But the earnings call revealed deeper insights that don’t show up in the headline numbers. Here are the most important takeaways.

Table of Contents

Q2 revenue declined 3.6% year over year to $1.12 billion. However, the prior-year quarter included roughly 49,000 catastrophe-related vehicles.

Excluding last year’s CAT impact, revenue actually increased modestly. The decline was more about normalization than structural weakness.

Global insurance units declined 9%, or 4% excluding CAT.

U.S. insurance units declined 10.7%, or 4.8% excluding CAT.

Management attributed this to:

Softer claims activity

Shifts in policies in force across carriers

Consumers raising deductibles or dropping collision coverage

They described these insurance behaviors as cyclical rather than structural.

One of the most important long-term drivers remains intact.

U.S. total loss frequency reached 24.2% in calendar Q4 2025. In 2015, it was 15.6%.

Even though accident frequency slowly declines due to safer vehicles, the percentage of vehicles deemed total losses keeps rising due to repair cost inflation and vehicle complexity.

This is a structural tailwind for Copart.

Despite normalization in used car values, Copart reported:

U.S. insurance ASPs up 6% year over year

Up 9% excluding CAT

Management emphasized that they are generating record selling prices for insurance consignors.

They attribute this to liquidity advantages, global buyer reach, and enhanced merchandising tools.

On the call, management stressed that fee pricing is not the main battleground.

The real differentiator is delivered economic outcome:

Higher selling prices

Faster cycle times

Reduced storage costs

Improved policyholder satisfaction

They argue these factors dwarf small fee differences between competitors.

The quarter included a $6.8 million one-time International VAT accrual.

After adjusting for CAT and this one-time item:

Gross profit increased slightly

Gross margin improved to 45%

This detail was not obvious from the press release alone.

Copart ended the quarter with:

Approximately $6.4 billion in liquidity

$5.1 billion in cash

No debt

Free cash flow increased 58% year to date.

This gives the company significant flexibility for land investment, buybacks, or acquisitions.

During the quarter:

Over 13 million shares repurchased fiscal year to date

More than $500 million deployed

Management described the buybacks as opportunistic, based on valuation and capital allocation priorities.

Copart has roughly 1,000 engineers globally and is deploying AI in:

Document processing

Driver dispatch

Business analytics

Image recognition

Total loss decision tools for insurers

Management described AI as materially improving productivity and enhancing long-term value delivery to customers.

Compared to a decade ago, Copart is in a much stronger land ownership position.

They now operate dedicated catastrophic facilities and maintain hundreds of acres reserved for storm activity.

Management emphasized that land development has long lead times, so they continue disciplined investment to ensure capacity remains ahead of demand over a 10-year horizon.

While Q2 showed lower year-over-year revenue and earnings, the earnings call reinforced several structural strengths:

Rising total loss frequency

Strong pricing power

Durable competitive moats

Massive liquidity

Disciplined capital allocation

The quarter reflects insurance cycle headwinds more than business model deterioration. The long-term thesis remains centered on liquidity, scale, and structural total loss growth.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Trending Posts

Copart Q2 FY2026 Earnings: 10 Key Takeaways on Insurance Trends, ASP Growth and Buybacks

Alphabet GOOGL Q4 2025 Earnings: 10 Key Takeaways on AI, Cloud Growth and $400B Revenue Milestone

10 Key AMD Earnings Insights From Q4 2025 and FY 2025 Every Investor Should Know

Amazon Q4 2025 Earnings Deep Dive: 10 Hidden Insights from the Press Release and Transcript

Meta Earnings Q4 2025: 12 Things Investors Miss If They Only Read The Press Release

Apple Q1 2026 Earnings Breakdown: Hidden Call Insights Investors Missed

Visa Earnings Call vs Policy Risk Reality: 10 Hidden Signals From Management Commentary (Q1 FY2026)

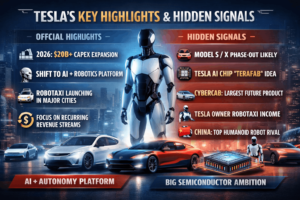

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com