-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

Palantir closed 2025 with record growth, record profitability, and one of the highest Rule of 40 scores ever seen in enterprise software. But beyond the official numbers, the earnings call transcript revealed deeper strategic shifts in how customers are using AI, how fast enterprise expansion is happening, and how Palantir is positioning itself as infrastructure rather than just software.

Below is a combined listicle covering official Q4 results, forward guidance, management strategy commentary, and the most important signals from the earnings call that were not obvious in the press release or investor presentation.

Table of Contents

Revenue reached about 1.41 billion, growing about 70 percent year over year and about 19 percent sequentially. This is the fastest growth rate since Palantir became public.

U.S. revenue grew about 93 percent year over year to about 1.08 billion. U.S. now represents roughly three quarters of total revenue, showing where AI adoption is strongest.

U.S. commercial revenue grew about 137 percent year over year to about 507 million, showing continued enterprise AIP acceleration

Total contract value reached about 4.26 billion, the highest quarterly level ever.

Adjusted operating margin reached about 57 percent.

Rule of 40 reached about 127 percent, one of the highest in the industry.

Adjusted free cash flow reached about 791 million with about 56 percent margin.

Revenue about 4.48 billion, up about 56 percent year over year.

Adjusted free cash flow about 2.27 billion.

GAAP net income about 1.63 billion.

Revenue expected about 1.53 to 1.54 billion.

Adjusted operating income expected about 870 to 874 million.

Revenue expected about 7.18 to 7.20 billion.

U.S. commercial revenue expected above 3.14 billion with at least 115 percent growth.

Adjusted operating income expected about 4.13 billion.

Adjusted free cash flow expected about 3.9 to 4.1 billion.

Leadership emphasized scaling operational leverage from AI rather than building AI models themselves, positioning Palantir at the value layer above models.

Examples included customers using Foundry daily across most employees and replacing multiple software stacks entirely.

Examples showed customers expanding from single digit million contracts to tens of millions in less than a year

Management stated they now help shape how customers design systems, not just supply software.

Management described potential expansion beyond shipbuilding into weapons, munitions, and broader industrial AI operating systems

Management highlighted strong U.S. and China adoption versus slower Europe and Canada adoption.

Management emphasized transforming fewer but larger institutions rather than maximizing number of customers.

Palantir Q4 2025 confirmed a major shift in enterprise AI. The official results show hyper growth and elite profitability. The transcript shows something deeper: companies are reorganizing around AI as a core operating layer, and Palantir is positioning itself as the infrastructure provider for that shift.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

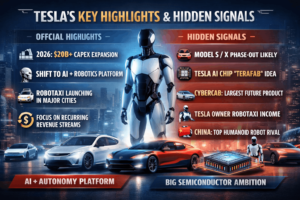

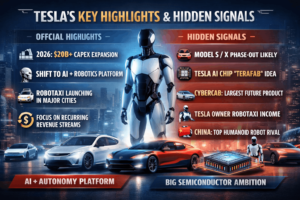

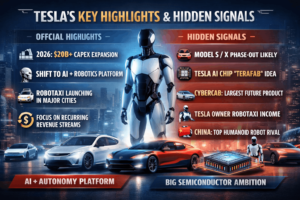

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

Trending Posts

Tesla Q4 FY2025 Earnings Highlights: AI, Robotaxi, Optimus and 2026 Growth Strategy

Palantir Q4 2025 Earnings Highlights, 2026 Guidance and Key Insights from Earnings Call Transcript

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

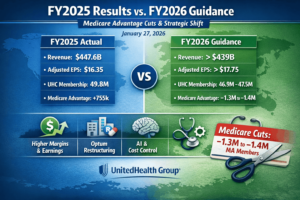

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

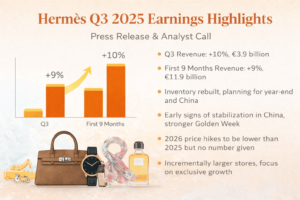

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com