-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

ASML delivered another strong earnings release for Q4 2025 and full year 2025, but the real story comes from combining the official results with management commentary from the earnings transcript. Below are the most important takeaways investors and industry watchers should know.

Table of Contents

ASML reported €32.7 billion revenue and €9.6 billion net income in 2025, with strong profitability and cash generation. Q4 alone delivered €9.7 billion revenue and €2.8 billion net income, marking one of the strongest quarters in company history.

ASML expects 2026 revenue between €34 billion and €39 billion with gross margin between 51% and 53%. This implies continued demand strength despite semiconductor cycle volatility.

Management repeatedly emphasized that customers have become more confident that AI demand is sustainable, not temporary. This is driving medium-term capacity expansion plans across logic and memory customers.

The transcript revealed that €25.5 billion of the €38.8 billion backlog is EUV-related. This shows future revenue is heavily skewed toward advanced lithography.

Management explicitly stated EUV revenue will increase meaningfully versus 2025, making it the primary growth engine for the company.

Q4 included revenue recognition for two High-NA systems. This marks an early but important milestone in the commercialization of next-generation lithography.

Management said China should represent roughly 20 percent of revenue, aligned with backlog exposure. This level of transparency was not highlighted in the press release but is important for geopolitical risk analysis.

While total non-EUV systems may be flat in 2026, demand remains strong in advanced logic, memory, metrology, and inspection.

Management signaled tight DRAM supply driven by HBM and DDR demand, which supports higher lithography intensity and stronger tool demand.

Customers are moving from 4nm to 3nm and ramping 2nm logic. In DRAM, 1b and 1c nodes are expanding. These transitions increase EUV layer counts and drive tool demand.

Customers increasingly use upgrades as the fastest way to increase output capacity. This supports recurring high-margin installed base service growth.

NXE 3800 reached 220 wafers per hour and even demonstrated 230 wafers per hour at some customers. High-NA qualification is progressing well, with early high-volume manufacturing preparation already happening.

The press release shows strong financial performance and steady guidance. The transcript reveals something more important: AI demand is pulling forward capacity, EUV dominance is accelerating, and technology adoption is happening faster than many expected. Together, these point to strong multi-year visibility for ASML, especially if AI infrastructure demand continues to expand.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

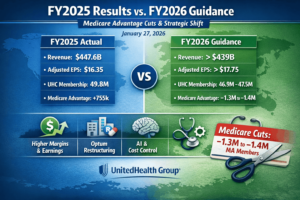

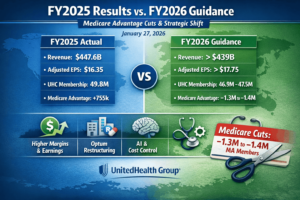

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

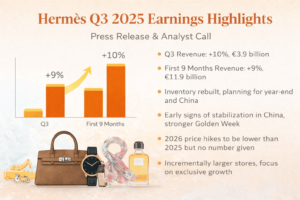

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com