-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

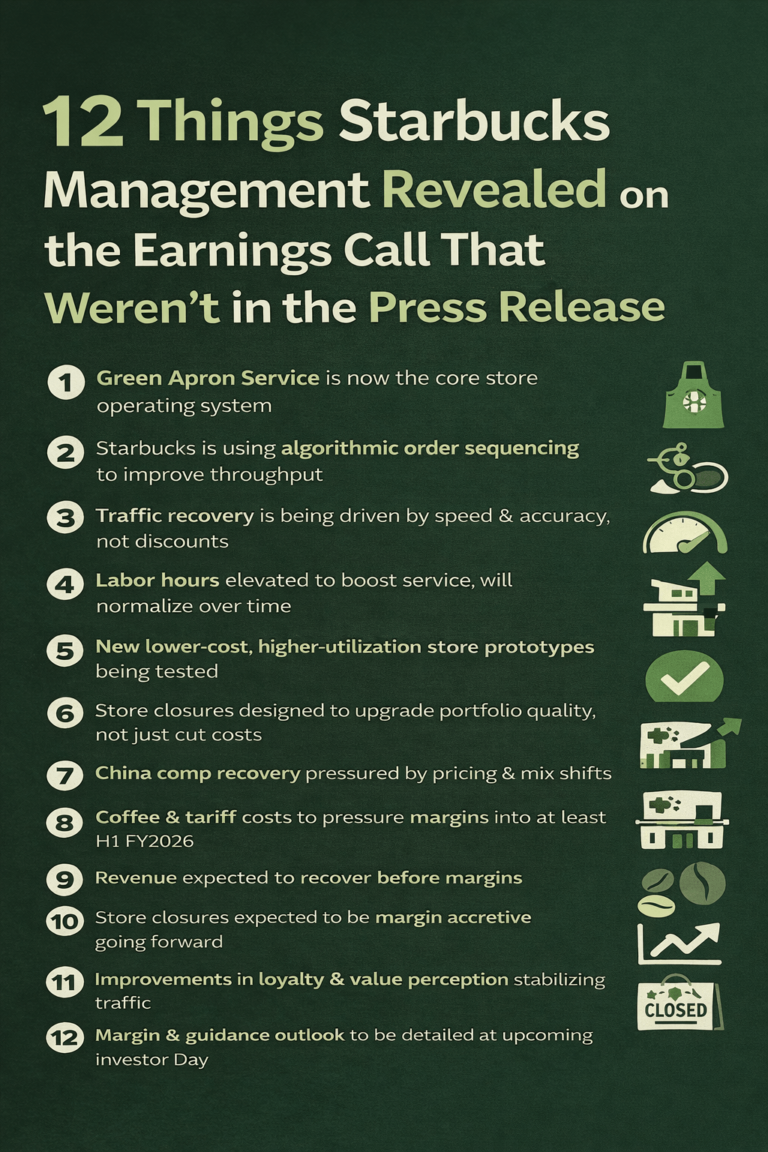

Starbucks’ Q4 FY2025 press release shows improving comps and a major restructuring. But the earnings call transcript tells a much deeper story about how the turnaround is actually being executed. Here are the most important insights investors would only catch by listening to the call.

Table of Contents

Management made it clear that Green Apron Service is no longer a pilot or side initiative. It is now the backbone of U.S. store operations. This includes how labor is deployed, how orders are sequenced, and how stores are run day-to-day. The press release only mentions labor investments, but the call explains this is a full operating model shift.

Executives revealed they rolled out a new smart sequencing algorithm to manage order flow across drive-thru, café, and mobile orders. This is a major operational change designed to improve throughput and reduce friction. The press release does not mention any use of algorithms in store operations.

Management said transaction growth is coming from faster service and better accuracy, not heavier promotions. This suggests Starbucks is rebuilding demand structurally rather than buying traffic with discounts. The press release only reports comps without explaining the drivers.

They explained that labor hours were intentionally increased to fix service issues. Over time, they expect productivity gains to allow labor efficiency to improve. The press release only frames labor as a cost pressure, not a strategic investment with expected payback.

Executives discussed testing new store formats with lower build costs and higher utilization. These prototypes are designed to improve unit economics and returns on invested capital. This is not mentioned at all in the press release.

Management said closures are part of upgrading the overall store base, not just cost cutting. They want to exit weaker formats and locations and shift to higher-quality, higher-return stores. The press release only lists closure numbers without explaining the strategic intent.

They explained that China is seeing strong transaction growth but weaker ticket due to pricing pressure and competition. The press release shows the numbers but does not explain the competitive and pricing dynamics behind them.

Management emphasized that China’s improvement is coming from operational improvements and value perception, not heavy discounting. This suggests a more sustainable recovery than if it were driven by promotions

Executives gave timing guidance, saying coffee costs and tariffs will likely remain a headwind through at least the first half of fiscal 2026. The press release broadly cites inflation but does not give a time window.

Management explicitly stated that traffic and revenue recovery will happen before margin recovery. This sequencing is critical for investor expectations but is not clearly stated in the press release.

They said removing underperforming stores should be slightly accretive to profitability over time. The press release does not frame closures as a future margin positive.

Executives highlighted improvements in Starbucks Rewards activity and value perception as key drivers of stabilizing traffic. The press release does not discuss loyalty behavior or customer psychology.

The transcript shows Starbucks’ turnaround is being driven by deep operational changes, not just marketing, pricing, or store count. The company is rebuilding its service model, using technology to manage throughput, redesigning store formats, and deliberately sequencing revenue recovery before margin recovery.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

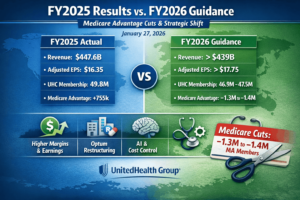

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

Trending Posts

ASML Earnings: 12 Things Management Said (Including What the Press Release Didn’t Tell You)

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

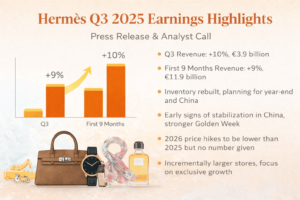

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com