-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

UnitedHealth Group released full-year 2025 results along with 2026 guidance, showing a clear strategic shift. While revenue is expected to be slightly lower, management is guiding for materially higher margins and earnings, driven by restructuring, pricing discipline, and a deliberate reduction of lower-quality membership.

Below is a side-by-side comparison of FY2025 actual results versus FY2026 guidance.

Table of Contents

| Metric | FY2025 Actual | FY2026 Guidance | Change / Commentary |

|---|---|---|---|

| Revenue | $447.6B | > $439.0B | Slight decline due to planned right-sizing |

| Earnings from Operations | $19.0B (GAAP) / $21.7B adjusted | > $24.0B | Strong rebound as restructuring effects roll off |

| GAAP EPS | $13.23 | > $17.10 | Significant YoY recovery |

| Adjusted EPS | $16.35 | > $17.75 | Moderate growth expected |

| Operating Margin | 2.7% | ~5.5% | Major margin expansion |

| Medical Care Ratio | 88.9% adjusted | 88.8% ± 50 bps | Slight improvement, better pricing discipline |

| Operating Cost Ratio | 12.9% adjusted | 12.8% ± 50 bps | Flat to slightly better cost control |

| Cash Flow from Operations | $19.7B | > $18.0B | Slight normalization after timing benefit |

| UnitedHealthcare Revenue | $344.9B | > $335.0B | Lower membership, planned contraction |

| UnitedHealthcare Operating Earnings | $9.4B | > $10.8B | Margin recovery despite lower revenue |

| UnitedHealthcare Operating Margin | 2.7% | ~3.2% | +50 bps improvement |

| Optum Revenue | $270.6B | > $257.5B | Strategic right-sizing |

| Optum Operating Earnings | $9.5B GAAP / $12.1B adjusted | > $13.2B | Margin recovery driven by Rx + restructuring |

| Optum Operating Margin | 3.5% | ~5.1% | Strong improvement |

| Group Net Margin | 2.7% | ~3.6% | Material profitability improvement |

| Membership (UHG) | 49.8M | 46.9M – 47.5M | Planned membership reduction |

| Medicare Advantage Members | +755k growth in 2025 | –1.3M to –1.4M | Major strategic contraction |

After growing by about 755,000 members in 2025, Medicare Advantage is expected to contract by 1.3 to 1.4 million members in 2026. Management is choosing margin recovery over membership growth.

UnitedHealthcare revenue is guided lower at over $335.0 billion, down from $344.9 billion. Despite this, operating earnings are expected to rise to over $10.8 billion, showing the impact of repricing and cost controls.

Optum revenue is expected to decline to over $257.5 billion from $270.6 billion. However, Optum operating earnings are guided higher at over $13.2 billion, driven by Optum Rx strength and restructuring at Optum Health.

Management highlighted aggressive use of AI and automation to reduce operating costs and improve efficiency. This is a key lever supporting margin expansion in 2026 and beyond.

On the earnings call, UNH criticized the proposed 2027 Medicare Advantage rates as disconnected from real medical cost trends. They warned the rates do not reflect elevated utilization and rising healthcare costs.

Management said lower rates would likely lead to reduced benefits, fewer plan choices, reduced access, and affordability challenges for seniors. They also warned they may need to exit certain markets and products if rates stay low.

UNH positioned integrated value-based care, Optum Health, and AI-driven efficiency as long-term defenses against government rate pressure. Management believes these areas can stabilize margins even if Medicare Advantage remains under pressure.

UnitedHealth is intentionally shrinking parts of its business to rebuild profitability. While 2026 looks like a margin recovery year, management is clearly preparing investors for continued Medicare Advantage pressure in 2027 and beyond. The company’s strategy is to protect earnings by focusing on higher-quality membership, cost discipline, Optum growth, and value-based care.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

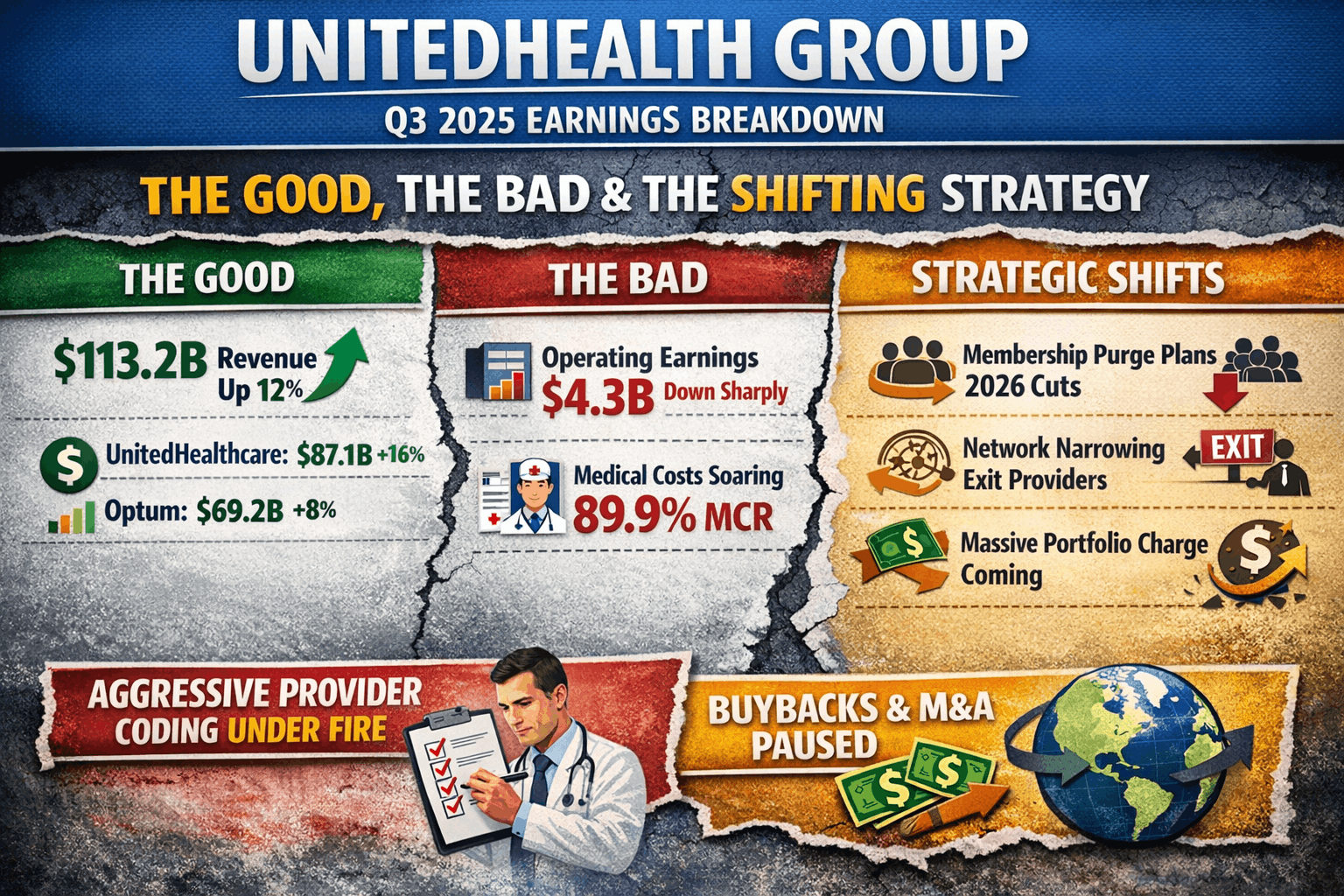

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

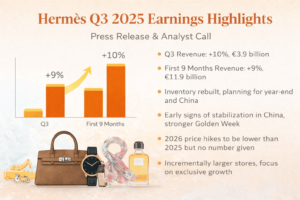

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Trending Posts

12 Things You Need to Know About UnitedHealth Group’s Q3 2025 Earnings (And the “Hidden” Bombshells)

LVMH Q3 2025 Earnings Explained: Key Highlights, Guidance, and Real Insights

Hermès Q3 2025 Earnings Explained Simply: What Really Matters for Investors

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Alphabet Q3 2025 Earnings: What the Slides Miss and the Transcript Reveals About AI Growth

Microsoft FY25 Q3 Earnings: Why Azure and AI Are Stronger Than The Numbers Show

NVIDIA Q3 FY2026 Earnings: What the Slides Did Not Tell You About the AI Supercycle

NVIDIA CES 2026 Highlights: Robots, AI Agents and the Vera Rubin Supercomputer

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com