-

- [adsw_currency_switcher]

- Home

- About Us

- Catalog

- Track Your Order

- Contact Us

- Shipping & Delivery

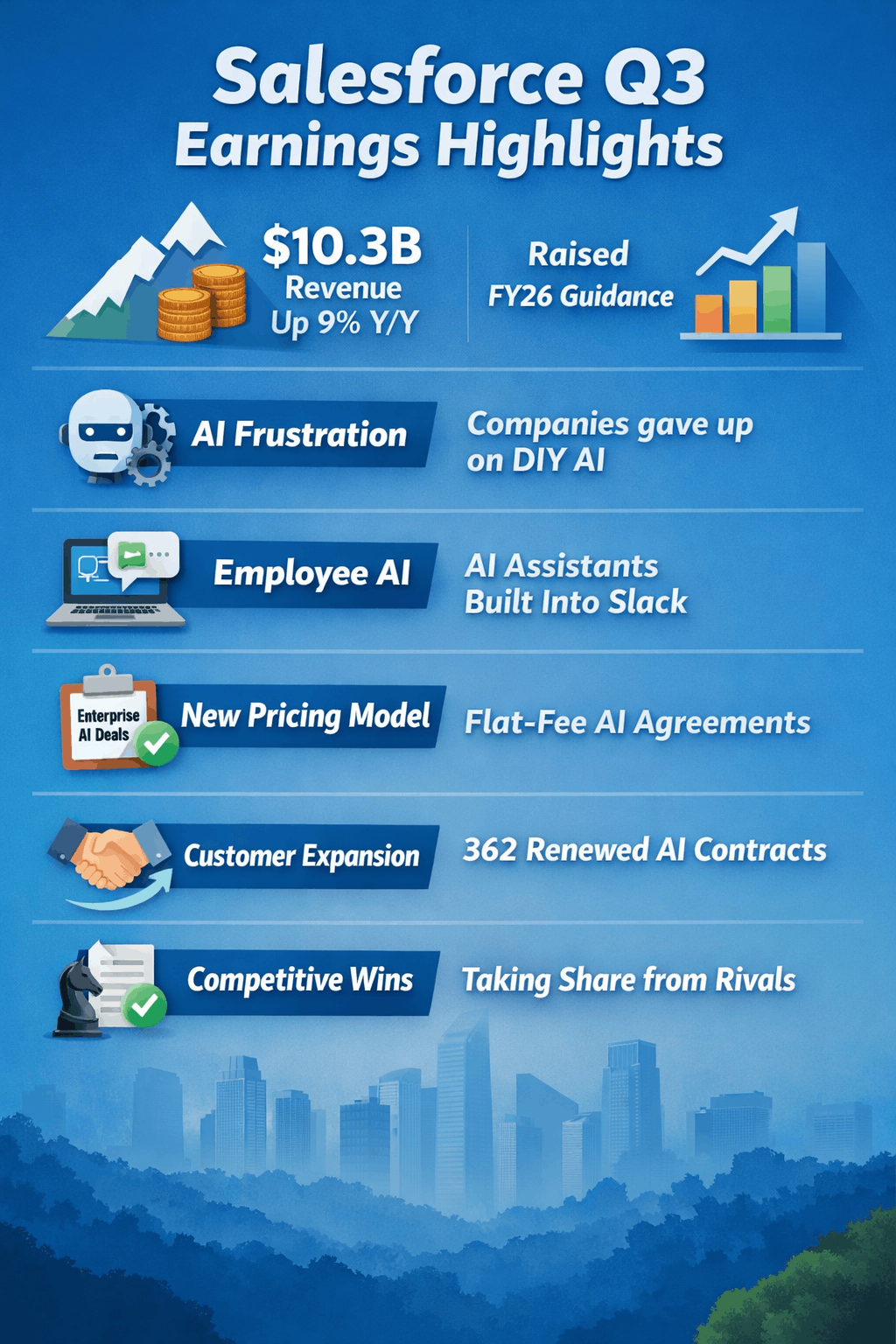

Salesforce reported its Q3 FY26 earnings. On the surface, the slides and press release showed solid growth, strong cash flow, and upbeat guidance. But during the earnings call, management shared many important details that never appeared clearly in the presentation.

This post explains everything in plain language, combining the official numbers with the real story from the earnings call.

Table of Contents

Financial performance

• Q3 FY26 revenue reached USD 10.3 billion, up 9% year over year and 8% in constant currency

• Subscription and support revenue was USD 9.7 billion, up 10% year over year

• Current remaining performance obligation (cRPO) grew 11% year over year to USD 29.4 billion

• Total remaining performance obligation (RPO) increased 12% year over year to USD 59.5 billion

• GAAP operating margin was 21.3%, while non-GAAP operating margin expanded to 35.5%

• Operating cash flow rose 17% year over year to USD 2.3 billion

• Free cash flow increased 22% year over year to USD 2.2 billion

• Salesforce returned USD 4.2 billion to shareholders, including USD 3.8 billion in share repurchases and USD 395 million in dividends

AI, Agentforce, and Data 360 momentum

• Agentforce and Data 360 annual recurring revenue reached nearly USD 1.4 billion, up 114% year over year

• Agentforce ARR alone exceeded USD 500 million, growing more than 330% year over year

• Over 18,500 Agentforce deals have been closed since launch, with more than 9,500 paid customers

• Agentforce processed more than 3.2 trillion AI tokens through Salesforce’s LLM gateway

• Around 50% of Agentforce and Data 360 bookings came from existing customer expansion

• Nearly 90% of Forbes Top 50 AI companies run on Salesforce, with an average of four Salesforce clouds per customer

Geographic and segment performance

• Americas revenue grew 8% year over year in constant currency

• Europe revenue grew 7% year over year in constant currency

• Asia Pacific revenue grew 11% year over year in constant currency, remaining the fastest-growing region

• Strong growth was led by Agentforce 360 Platform, Slack, and Data offerings, with high-teens constant currency growth

Management commentary themes (from earnings call)

• Management highlighted strong enterprise demand for agentic AI use cases rather than experimental pilots

• Salesforce emphasized monetization discipline, focusing on profitable AI growth rather than usage-only metrics

• Informatica acquisition was positioned as a strategic data foundation to strengthen AI trust, governance, and enterprise adoption

• Leadership reiterated confidence in achieving the long-term target of USD 60 billion plus organic revenue by FY30 under its Profitable Growth Framework

Guidance summary

Full-year FY26 guidance

• Revenue guidance raised to USD 41.45–41.55 billion, representing 9–10% year-over-year growth

• Subscription and support revenue growth expected to be slightly above 10% year over year

• GAAP operating margin guidance updated to 20.3%

• Non-GAAP operating margin maintained at 34.1%

• GAAP diluted EPS expected at USD 7.22–7.24

• Non-GAAP diluted EPS expected at USD 11.75–11.77

• Operating cash flow growth expected at approximately 13–14% year over year

• Free cash flow growth expected at approximately 13–14% year over year

4 FY26 guidance

• Revenue expected in the range of USD 11.13–11.23 billion

• Revenue growth projected at 11–12% year over year

• GAAP diluted EPS expected at USD 1.47–1.49

• Non-GAAP diluted EPS expected at USD 3.02–3.04

• cRPO growth expected at approximately 15% year over year, or about 13% in constant currency

In the call, Salesforce clearly said many companies tried to build their own AI tools using ChatGPT-like models. After 1–2 years, they got frustrated because it was harder, riskier, and more expensive than expected. Slides only show growth numbers, not this “customers gave up on DIY AI” reality.

Slides mostly talk about AI talking to customers. In the call, Salesforce spent a lot of time talking about AI helping employees internally through Slack, like a super smart assistant for staff. This is a big future growth area but is barely visible in the slides.

The call explained pricing in detail, but slides did not.

Salesforce now lets big customers pay a flat yearly fee for AI instead of paying per use.

These are large, multi-million dollar deals.

This makes customers less worried about “AI bills going out of control.”

This pricing change is important but never shown on the slides.

The transcript revealed a major pricing and monetization shift not detailed in slides:

Salesforce introduced Agentic Enterprise License Agreements (ILA), flat-fee, multimillion-dollar deals covering broad agentic deployment.

16 ILAs were closed in Q3, with about 100 more in the pipeline.

Seat-based, usage-based, and hybrid pricing options are now all actively used, depending on customer maturity.

This pricing strategy discussion is entirely absent from the presentation visuals.

Slides show total growth, but the call revealed something stronger:

362 customers came back in Q3 to spend more on AI after already using it.

Earlier in the year, only 3 customers did that.

This shows AI is actually working in real business, not just pilots.

In the call, management said they increased sales capacity by about 23%.

They trained these people early, before demand fully arrived.

Slides do not mention this, but it matters a lot for growth in 2026–2027.

Slides show customer logos only.

In the call, Salesforce directly said they are taking business from competitors like Veeva and other IT service software companies, and replacing other chat and collaboration tools with Slack.

The call gave eye-opening numbers not shown clearly in slides:

Tens of trillions of data records processed

Trillions of AI tokens used

This shows Salesforce AI is already running at real enterprise scale, not just demos.

Slides list government customers.

The call explained real outcomes like:

IRS cutting case setup time from days to minutes

UK police reducing non-emergency calls by 20% using AI

These results make the story more real but are not visualized in slides.

In the Q&A, management clearly said:

AI models alone are cheap and replaceable

What matters is data, workflows, and business rules

That is why companies still need Salesforce

This defense against the “AI replaces SaaS” fear is not stated in the slides

The slides and press release showed strong numbers. The earnings call explained why those numbers are likely to continue.

Customers are moving away from DIY AI

AI is being used in real production

Pricing has become easier and safer for customers

Salesforce prepared its sales force early

Competitive wins are increasing

AI is operating at real enterprise scale

Together, these signals suggest Salesforce is not just riding an AI trend, but building a long-term platform that customers depend on.

Thank you for reading this post. If you enjoy this post, please share it with your friends or family members. Let’s get life transformed together! Many thanks.

Trending Posts

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Alphabet Q3 2025 Earnings: What the Slides Miss and the Transcript Reveals About AI Growth

Microsoft FY25 Q3 Earnings: Why Azure and AI Are Stronger Than The Numbers Show

NVIDIA Q3 FY2026 Earnings: What the Slides Did Not Tell You About the AI Supercycle

NVIDIA CES 2026 Highlights: Robots, AI Agents and the Vera Rubin Supercomputer

Trending Posts

Salesforce FY26 Q3 Earnings Explained: Key Highlights Beyond the Slides

TSMC Q4 2025 Earnings Review: Financial Highlights and Hidden Insights from the Transcript

Alphabet Q3 2025 Earnings: What the Slides Miss and the Transcript Reveals About AI Growth

Microsoft FY25 Q3 Earnings: Why Azure and AI Are Stronger Than The Numbers Show

NVIDIA Q3 FY2026 Earnings: What the Slides Did Not Tell You About the AI Supercycle

NVIDIA CES 2026 Highlights: Robots, AI Agents and the Vera Rubin Supercomputer

Copyright 2021 © MR Life Changer | Powered by www.mrlifechanger.com

For business collaboration/enquiries, please contact: mr.life.changer9@gmail.com